Delve into the realm of Trip Insurance for International Trips: What’s Covered? to uncover a world of protection and assurance for your global adventures. This topic promises to shed light on the intricacies of trip insurance coverage, offering a glimpse into the security it provides for your journeys abroad.

Understanding Trip Insurance Coverage

Trip insurance for international trips provides financial protection in case of unexpected events that may disrupt or cancel your travel plans. It typically covers a range of situations such as trip cancellations, delays, medical emergencies, lost luggage, and more.

Types of Coverage Included in Trip Insurance Policies

- Trip Cancellation: Reimburses you for prepaid, non-refundable trip costs if you have to cancel for a covered reason.

- Travel Medical Coverage: Covers medical expenses, emergency medical evacuation, and repatriation in case of illness or injury while traveling.

- Baggage Loss or Delay: Provides reimbursement for lost, stolen, or delayed baggage during your trip.

- Travel Delay: Reimburses additional expenses due to travel delays caused by covered reasons.

- Emergency Assistance Services: Offers 24/7 support for emergencies such as medical referrals, translation services, and legal assistance.

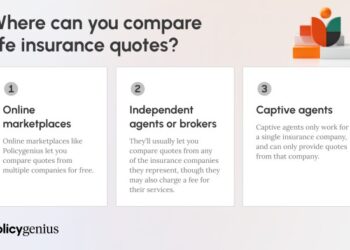

Comparison of Coverage Offered by Different Trip Insurance Providers

When choosing a trip insurance provider, it's essential to compare the coverage offered by different companies. Some providers may offer additional benefits like rental car coverage, adventure sports coverage, or coverage for pre-existing medical conditions. Compare the limits, exclusions, and terms of each policy to find the best fit for your travel needs.

Scenarios Where Trip Insurance Coverage Can Be Beneficial

- Illness or Injury: If you or a family member falls ill or gets injured before or during your trip, trip insurance can cover medical expenses and emergency medical evacuation.

- Flight Cancellations: In case your flight gets canceled due to weather, strikes, or other covered reasons, trip insurance can help reimburse you for unused travel expenses.

- Lost Luggage: If your luggage is lost or stolen during your trip, trip insurance can provide compensation for your belongings.

- Natural Disasters: If your destination is affected by a natural disaster and you need to cancel or cut short your trip, trip insurance can cover your losses.

Medical Coverage

Travel insurance for international trips typically covers a range of medical expenses to ensure travelers are protected in case of unexpected health issues abroad. This type of coverage is crucial as medical care can be expensive in foreign countries, and travelers may not have access to their regular health insurance providers.

What’s Covered

- Emergency medical treatment for illness or injury

- Hospital stays and services

- Evacuation to a suitable medical facility

- Prescription medications

- Dental treatment for acute pain

Importance of Medical Coverage

Travel insurance with medical coverage is essential because it ensures that travelers can receive the necessary care without worrying about the financial burden. In case of an emergency, having coverage can make a significant difference in getting timely and appropriate medical attention.

Examples of Crucial Situations

- Accidents requiring hospitalization

- Severe illnesses requiring medical evacuation

- Emergency dental procedures due to sudden pain

Comparison of Medical Coverage

Different trip insurance policies may offer varying levels of medical coverage, including different limits for medical expenses, evacuation costs, and deductibles. It's important for travelers to carefully compare these aspects when choosing a policy to ensure they have adequate protection for their specific needs.

Trip Cancellation and Interruption Coverage

Trip cancellation and interruption coverage is a crucial part of trip insurance that protects travelers in case they need to cancel or cut their trip short due to unforeseen circumstances. This coverage helps reimburse the non-refundable expenses incurred for the trip.

Reasons Covered under Trip Cancellation and Interruption Insurance

- Illness or injury of the traveler or a family member

- Death of a family member

- Natural disasters impacting the travel destination

- Terrorist incidents in the travel destination

- Travel supplier bankruptcy

Scenarios where Trip Cancellation and Interruption Coverage is Useful

- If a traveler falls ill before the trip and cannot travel as planned

- In case of a family emergency requiring the traveler to return home early

- If the travel destination is hit by a hurricane or earthquake, forcing the cancellation of the trip

Comparison of Trip Cancellation and Interruption Coverage by Insurance Providers

| Insurance Provider | Coverage Details |

|---|---|

| Provider A | Provides coverage for trip cancellations due to illness, injury, or death of a family member. |

| Provider B | Offers coverage for trip interruptions caused by natural disasters and terrorist incidents. |

| Provider C | Includes coverage for travel supplier bankruptcies and trip cancellations for any reason. |

Baggage and Personal Belongings Coverage

When it comes to international travel, protecting your baggage and personal belongings is essential. Trip insurance typically includes coverage for lost, stolen, or damaged baggage to provide peace of mind during your journey.

Coverage Details

- Baggage and personal belongings coverage typically reimburses you for the cost of replacing essential items such as clothing, toiletries, and electronics in case they are lost, stolen, or damaged during your trip.

- Some policies may also cover expenses related to delayed baggage, such as purchasing necessary items while waiting for your belongings to arrive.

- Coverage limits and exclusions may vary, so it's important to review your policy to understand what items are covered and up to what amount.

Reimbursement Process

- If your baggage is lost, stolen, or damaged, you should report the incident to the airline or local authorities immediately and keep all relevant documentation, such as receipts and police reports.

- Next, contact your trip insurance provider to file a claim. You will likely need to provide proof of ownership and value for the items in question.

- Once your claim is approved, you may receive reimbursement for the cost of replacing the lost, stolen, or damaged items based on your policy's coverage limits.

Importance of Baggage Coverage

- Baggage coverage is crucial for international trips where you may be carrying valuable items or traveling long distances, increasing the risk of loss or theft.

- In case your luggage is misplaced or items are stolen during your trip, having baggage coverage can help alleviate the financial burden of replacing essential belongings.

Benefits of Baggage Coverage

- Example 1: Imagine your luggage is lost during a layover, and you have to purchase new clothes and toiletries. Baggage coverage can reimburse you for these expenses.

- Example 2: If your camera is damaged while on a sightseeing tour, baggage coverage can help cover the repair or replacement costs.

Closing Summary

As we near the end of our exploration into Trip Insurance for International Trips: What’s Covered?, the tapestry of coverage and protection comes into full view. From medical emergencies to trip cancellations, this discussion has illuminated the vital role that trip insurance plays in ensuring peace of mind during your travels.

FAQ

What does trip insurance for international trips typically cover?

Trip insurance usually covers medical emergencies, trip cancellations, baggage loss, and other unforeseen events during international travel.

How do I know if I need trip insurance for my international trip?

It's recommended to consider trip insurance if your trip involves significant expenses or risks that could impact your travel plans.

Is trip insurance for international trips worth the cost?

Trip insurance can be valuable for peace of mind and financial protection in case of emergencies, making it worth the investment for many travelers.