As we look ahead to 2025, the landscape of car insurance is evolving rapidly. From technological advancements to shifting trends, there's much to consider when shopping for car insurance. Join us on a journey through the future of car insurance and discover how you can navigate this changing terrain with confidence.

Understanding Car Insurance in 2025

In 2025, the car insurance industry is expected to see significant changes driven by various factors such as advancements in technology, shifting consumer preferences, and evolving regulations. Understanding these changes is crucial for individuals looking to secure the right car insurance coverage at the best possible rates.

Key Changes in Car Insurance Trends by 2025

- Usage-Based Insurance: With the widespread adoption of telematics devices and artificial intelligence, more insurance companies are offering usage-based insurance policies. These policies calculate premiums based on driving behavior, rewarding safe drivers with lower rates.

- Personalized Policies: Insurers are increasingly using data analytics to tailor insurance policies to individual drivers. This personalized approach allows for more accurate risk assessment and pricing, leading to fairer premiums.

- Shift Towards Electric Vehicles: As electric vehicles become more prevalent on the roads, insurance companies are adjusting their coverage options and pricing models to accommodate the unique needs of EV owners.

Factors Impacting Car Insurance Costs in 2025

- Advanced Safety Features: Vehicles equipped with advanced safety features such as autonomous emergency braking, lane-keeping assist, and adaptive cruise control may qualify for discounts on insurance premiums due to reduced accident risks.

- Climate Change: The increasing frequency of extreme weather events and natural disasters can impact insurance costs by leading to higher claims payouts and overall increased risk for insurers.

- Rising Healthcare Costs: Medical expenses related to car accidents play a significant role in determining insurance premiums. As healthcare costs continue to rise, insurers may adjust their rates accordingly.

Technology Shaping the Car Insurance Industry by 2025

- Artificial Intelligence: AI-powered algorithms are being used to streamline claims processing, detect fraudulent activities, and personalize insurance offerings, enhancing efficiency and customer experience.

- Blockchain Technology: The use of blockchain for secure data storage and transactions is improving data security, reducing administrative costs, and enhancing transparency in the insurance industry.

- Mobile Apps: Insurance companies are developing user-friendly mobile apps that allow policyholders to manage their accounts, file claims, and access support services conveniently, promoting customer engagement and satisfaction.

Researching the Best Car Insurance Options

When looking for the best car insurance options in 2025, it is essential to consider innovative companies that offer personalized plans tailored to individual needs. With the advancements in technology, new tech-driven options have emerged, providing policyholders with more flexibility and convenience than ever before.

Innovative Car Insurance Companies to Consider

- 1. Metromile: A pay-per-mile insurance company that caters to low-mileage drivers, offering customized rates based on actual usage.

- 2. Root Insurance: Utilizes telematics technology to track driving behavior and offers discounts to safe drivers.

- 3. Lemonade: Known for its hassle-free claims process and transparent pricing, Lemonade provides a refreshing approach to car insurance.

Comparison of Traditional vs. Tech-Driven Options

- Traditional Car Insurance: Typically offers fixed premiums based on factors like age, location, and driving history, with limited opportunities for customization.

- Tech-Driven Options: Utilize data analytics and artificial intelligence to offer usage-based policies, discounts for safe driving habits, and seamless digital experiences.

Importance of Personalized Insurance Plans

Personalized insurance plans are crucial as they take into account individual needs and driving habits, ensuring that policyholders are not overpaying for coverage they do not require. By tailoring insurance plans to specific requirements, individuals can benefit from cost savings and enhanced coverage options that align with their lifestyle and driving behavior.

Using Technology to Shop for Car Insurance

In 2025, advancements in technology are playing a significant role in revolutionizing the way consumers shop for car insurance. Artificial intelligence, big data, and blockchain technology are reshaping the car insurance industry, making it easier for individuals to find the right coverage that suits their needs.

Artificial Intelligence in Car Insurance Shopping

Artificial intelligence is enhancing the car insurance shopping experience by providing personalized recommendations based on individual driving habits, preferences, and risk factors. AI algorithms can analyze vast amounts of data quickly and accurately to match consumers with the most suitable insurance options.

This technology streamlines the shopping process, saving time and ensuring that customers get the coverage they need at competitive rates.

Big Data for Finding the Right Coverage

Big data is playing a crucial role in helping consumers find the right car insurance coverage by analyzing patterns and trends in driving behavior, claims data, and other relevant information. By leveraging big data analytics, insurance companies can tailor their offerings to meet the unique needs of each customer.

This personalized approach ensures that individuals are not overpaying for coverage they do not need, ultimately leading to more cost-effective insurance solutions.

Blockchain Technology in Car Insurance Management

Blockchain technology is revolutionizing the way car insurance is purchased and managed in 2025 by providing a secure and transparent platform for transactions. Through blockchain, insurance companies can streamline the claims process, reduce fraud, and ensure the integrity of customer data.

This technology also allows for smart contracts to be executed automatically, providing a more efficient and trustworthy way to manage car insurance policies.

Tips for Making Informed Decisions

When it comes to making informed decisions about car insurance in 2025, there are several key strategies and tips to keep in mind. From effectively comparing quotes to understanding policy terms and leveraging online tools, here are some essential considerations for navigating the car insurance market.

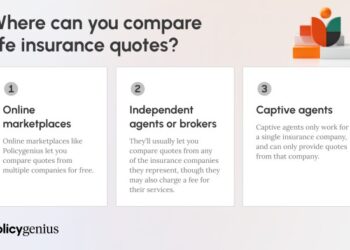

Comparing Car Insurance Quotes Effectively

- Utilize online comparison tools: Take advantage of websites and apps that allow you to compare multiple car insurance quotes from different providers in one place.

- Consider coverage options: Look beyond just the price and evaluate the coverage and benefits offered by each policy to ensure it meets your needs.

- Review discounts and incentives: Check for any discounts or incentives that may be available to you based on your driving record, age, or other factors.

Understanding Policy Terms and Conditions

- Read the fine print: Take the time to carefully review the terms and conditions of each policy to understand what is covered, what is excluded, and any limitations or restrictions.

- Ask questions: If there are any terms or clauses that you don't understand, don't hesitate to reach out to the insurance provider for clarification.

- Consider add-ons: Evaluate optional coverages or add-ons that may enhance your policy but be mindful of the additional costs involved.

Leveraging Online Tools for Shopping

- Use comparison websites: Explore online platforms that allow you to compare prices, coverage options, and customer reviews for various car insurance companies.

- Take advantage of calculators: Some websites offer premium calculators that can help you estimate the cost of different policies based on your specific needs and circumstances.

- Check customer reviews: Look for feedback from other policyholders to get a sense of the quality of service and claims experience provided by different insurers.

Ending Remarks

With a focus on leveraging technology, understanding key trends, and making informed decisions, shopping for car insurance in 2025 is poised to be a seamless and personalized experience. Stay ahead of the curve and ensure you find the right coverage for your needs by embracing the strategies and insights discussed in this guide.

Essential Questionnaire

How will technology impact car insurance shopping in 2025?

In 2025, technology will enhance the car insurance shopping experience through artificial intelligence, big data, and blockchain, making it more personalized and efficient.

What are some innovative car insurance companies to consider in 2025?

Companies like XYZ Insurance and ABC Insure are at the forefront of offering tech-driven car insurance options tailored to individual needs.

How can consumers effectively compare car insurance quotes in 2025?

Consumers can utilize online tools and strategies Artikeld in this guide to compare quotes effectively and make informed decisions.