Embarking on the journey of Real Life Insurance Tips for Today’s Families, this introduction sets the stage for an informative discussion that delves into the intricacies of securing your family’s future.

Exploring the various facets of real life insurance and how it can benefit modern families, this guide aims to provide valuable insights and practical tips for making informed decisions.

Importance of Real Life Insurance

Real life insurance plays a crucial role in providing financial security for today's families. It ensures that loved ones are protected in unexpected situations and helps alleviate the financial burden during challenging times. The peace of mind that comes with knowing your family is safeguarded by insurance is invaluable.

Financial Security in Unexpected Situations

Real life insurance serves as a safety net for families, offering financial protection in the event of the policyholder's death. This financial support can cover expenses such as mortgage payments, children's education, daily living costs, and even funeral expenses. Without real life insurance, families may face significant financial hardships and struggle to maintain their standard of living.

Protection Against Debt and Loans

In the unfortunate event of a policyholder's passing, real life insurance can help cover outstanding debts and loans, preventing the burden from falling on surviving family members. This ensures that families are not left with overwhelming financial obligations and can focus on grieving and moving forward without the added stress of debt repayment.

Income Replacement

Real life insurance can provide a source of income replacement for families who rely on the policyholder's earnings. This ensures that loved ones can maintain their financial stability and continue to meet their financial obligations even after the loss of the primary breadwinner.

It offers a sense of security and stability during a time of great uncertainty.

Legacy Planning

Beyond providing financial security, real life insurance can also be used as a tool for legacy planning. It allows policyholders to leave a lasting impact by passing on wealth to future generations, supporting charitable causes, or funding educational endeavors. This ensures that their legacy continues to thrive and make a positive difference in the lives of others.

Types of Real Life Insurance Policies

When it comes to protecting your family's financial future, real life insurance policies play a crucial role. Understanding the different types of life insurance available can help you make an informed decision that best suits your needs.

Term Life Insurance

Term life insurance provides coverage for a specific period, usually ranging from 10 to 30 years. It offers a death benefit to your beneficiaries if you pass away during the term of the policy. This type of insurance is usually more affordable compared to other options, making it a popular choice for young families.

- Benefits:

- Lower premiums

- Simple and straightforward coverage

- Provides financial protection during specific life stages

- Drawbacks:

- No cash value accumulation

- Coverage ends after the term expires

- Renewal premiums can increase significantly

Whole Life Insurance

Whole life insurance offers coverage for your entire life, as long as premiums are paid. It not only provides a death benefit but also includes a cash value component that grows over time. This type of policy offers stability and long-term financial protection.

- Benefits:

- Lifetime coverage

- Cash value accumulation

- Fixed premiums

- Drawbacks:

- Higher premiums compared to term life insurance

- Complexity in policy structure

- Lower returns on cash value compared to other investment options

Universal Life Insurance

Universal life insurance offers flexibility in premium payments and death benefits. It combines the protection of life insurance with a savings component that earns interest over time. This type of policy allows you to adjust coverage and premiums according to your changing needs.

- Benefits:

- Flexible premium payments

- Cash value growth potential

- Adjustable death benefits

- Drawbacks:

- Market-related interest rates can impact cash value growth

- Policy complexity and management

- Requires regular monitoring and adjustments

Factors to Consider When Choosing Insurance

When selecting a real life insurance policy for your family, there are several important factors to consider. These factors can help you determine the right coverage amount, premiums, and policy terms that suit your family's financial needs.

1

. Coverage Amount

Determining the appropriate coverage amount is crucial when choosing a real life insurance policy. Consider factors such as your family's current expenses, future financial goals, outstanding debts, and potential education costs for children.

2. Premiums

The premium amount you pay for your insurance policy is an essential factor to consider. Make sure the premiums are affordable and fit within your budget without causing financial strain. Compare quotes from different insurance providers to find the best rates.

3. Policy Terms

Review the policy terms carefully to understand what is covered and what is not. Look out for any exclusions or limitations in the policy. Consider factors like the policy term length, renewal options, and any additional benefits or riders that can be added to customize your coverage.

4. Family’s Financial Needs Assessment

Assess your family's financial needs by calculating your current income, expenses, savings, investments, and future financial goals. Consider factors like inflation, emergency funds, retirement planning, and potential changes in financial circumstances. This assessment will help you determine the right insurance policy that provides adequate protection for your family.

Understanding Insurance Terms and Jargon

When navigating the world of insurance, families may come across various terms and jargon that can be confusing. It is essential to understand these terms to make informed decisions about your insurance coverage.

Premiums

Premiums are the amount of money you pay to the insurance company in exchange for coverage. They can be paid monthly, quarterly, or annually, depending on the policy.

Deductibles

A deductible is the amount of money you are required to pay out of pocket before your insurance coverage kicks in. For example, if you have a $500 deductible and a covered claim costs $1,000, you would pay $500, and the insurance company would cover the remaining $500.

Beneficiaries

Beneficiaries are the individuals or entities designated to receive the benefits from your insurance policy in the event of your death. It is crucial to keep your beneficiaries updated to ensure that your wishes are carried out.

Riders

Riders are additional provisions that can be added to your insurance policy to customize your coverage. For example, you may add a rider for critical illness coverage or accidental death benefits.

Understanding insurance terms and jargon can help families choose the right coverage for their needs and ensure they are adequately protected in times of need.

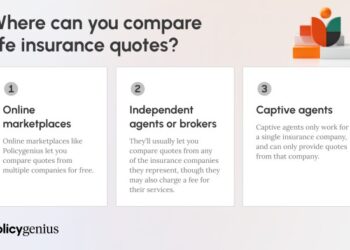

Tips for Finding Affordable Insurance

Finding affordable real life insurance policies is crucial for today's families. It ensures financial security without breaking the bank. Here are some strategies to help you find affordable insurance and lower premiums without compromising coverage:

Negotiate with Insurance Providers

When looking for affordable insurance, don't hesitate to negotiate with insurance providers. You can often get better rates by discussing your needs and exploring different options. Be sure to ask about discounts or special offers that may apply to your situation.

Compare Multiple Quotes

One of the best ways to find affordable insurance is to compare quotes from multiple providers. Take the time to research different policies and pricing options to see which one offers the best value for your needs. Remember, the cheapest option may not always provide the coverage you require.

Consider Bundling Policies

Another way to save on insurance costs is to bundle multiple policies with the same provider. For example, combining your auto and home insurance with one company can often lead to significant discounts. Be sure to inquire about bundle options when shopping for insurance.

Review Your Coverage Regularly

To ensure you are getting the most affordable insurance, review your coverage regularly. As your life circumstances change, your insurance needs may also evolve. By reassessing your coverage periodically, you can make adjustments to ensure you are not overpaying for unnecessary protection.

Maintain a Good Credit Score

Believe it or not, your credit score can impact your insurance premiums. Insurance companies often use credit scores to determine rates, so maintaining a good credit score can help you secure lower premiums. Be sure to monitor your credit and address any issues that may be negatively affecting your score.

Ultimate Conclusion

Wrapping up our exploration of Real Life Insurance Tips for Today’s Families, we have covered essential aspects of insurance policies, factors to consider, understanding insurance terms, and tips for affordability. By prioritizing your family's financial security, you can navigate the realm of insurance with confidence and peace of mind.

FAQ Explained

What are the key benefits of real life insurance for families?

Real life insurance provides financial security in unexpected situations, peace of mind knowing your family is protected, and a safety net for future uncertainties.

How can families determine the right insurance policy for their needs?

Families should consider factors like coverage amount, premiums, and policy terms while assessing their financial needs to choose the most suitable insurance policy.

What are some strategies for finding affordable insurance policies?

To find affordable insurance, families can explore ways to lower premiums without compromising coverage, compare different policy options, and negotiate with providers for better rates.