Exploring the essential aspects of Life Insurance and Critical Illness Cover: What’s Most Important?, we delve into a comprehensive discussion that sheds light on the key considerations for individuals and families.

This narrative aims to provide valuable insights and guidance on navigating the complexities of insurance coverage decisions.

Importance of Life Insurance

Life insurance is a crucial financial tool that provides protection and security for individuals and their families in the event of unexpected circumstances. It offers a safety net by ensuring that loved ones are taken care of financially in case of the policyholder's death.Life insurance can benefit individuals and families in various ways.

Firstly, it helps cover funeral expenses and outstanding debts, relieving the burden on the surviving family members. Secondly, it provides income replacement for dependents, ensuring that they can maintain their standard of living even after the policyholder is no longer there to provide for them.

Additionally, life insurance can also be used to fund a child's education or provide for the care of a disabled family member.The peace of mind that comes with knowing loved ones are financially protected is invaluable. By having life insurance coverage, individuals can have reassurance that their family's financial future is secure, even in their absence.

This sense of security allows them to focus on living their lives without worrying about the financial implications of unforeseen events.

Critical Illness Cover Benefits

When it comes to protecting yourself and your loved ones, critical illness cover offers additional benefits beyond traditional life insurance. In the event of a serious illness diagnosis, this type of coverage can provide financial support to help you navigate through challenging times.

Key Advantages of Critical Illness Cover:

- Financial Protection: Critical illness cover offers a lump sum payment upon diagnosis of a covered illness, providing financial stability to cover medical expenses, ongoing care, and other financial obligations.

- Peace of Mind: Knowing that you have critical illness cover in place can offer peace of mind, allowing you to focus on recovery without worrying about the financial impact of your illness.

- Flexibility: The lump sum payment from critical illness cover can be used in a variety of ways, such as paying off debts, covering lost income, or making necessary home modifications for medical care.

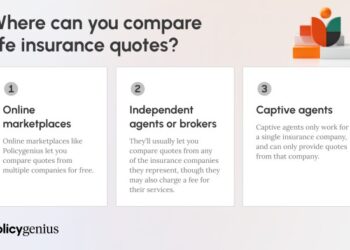

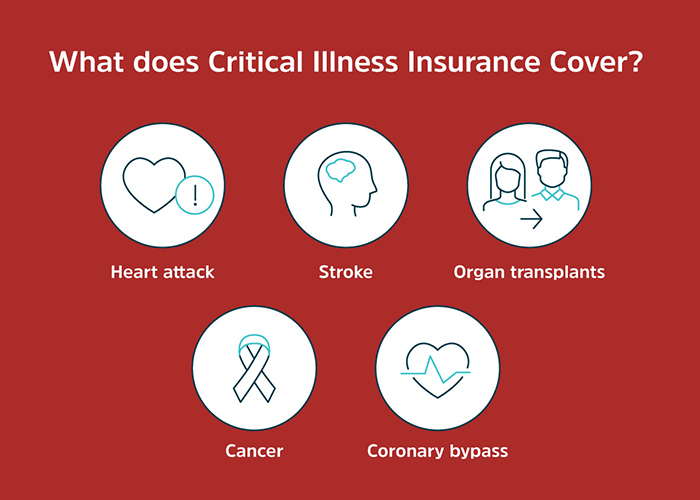

Examples of Critical Illnesses Covered:

Critical illness cover typically includes a range of serious illnesses such as:

- Cancer

- Heart Attack

- Stroke

- Organ Failure

These illnesses can have a significant impact on your finances due to medical expenses, treatment costs, and potential loss of income if unable to work.

Financial Stability During Challenging Times:

Having critical illness cover can provide you and your family with the financial stability needed to focus on recovery and healing during difficult times. Instead of worrying about how to cover medical bills or daily expenses, you can have peace of mind knowing that you have a financial safety net in place.

Key Differences Between Life Insurance and Critical Illness Cover

Life insurance and critical illness cover are both essential types of insurance, but they serve different purposes and provide different benefits. It's important to understand the distinctions between the two to make an informed decision about which type of coverage is most important for your needs.

Coverage and Benefits

- Life insurance provides a lump sum payment to your beneficiaries in the event of your death.

- Critical illness cover, on the other hand, pays out a lump sum if you are diagnosed with a specified critical illness listed in your policy.

- Life insurance offers financial protection to your loved ones after you pass away, helping them cover expenses like mortgage payments, debts, and daily living costs.

- Critical illness cover provides financial support to help you cover medical expenses, treatment costs, and other financial obligations if you are diagnosed with a critical illness.

Limitations and Situational Importance

- Life insurance does not provide coverage for critical illnesses, so if you are diagnosed with a serious illness, your life insurance policy will not pay out.

- Critical illness cover typically has a list of specific critical illnesses that are covered by the policy, and if your illness is not on the list, you may not receive a payout.

- In situations where you have dependents and want to ensure their financial security after you pass away, life insurance may be more important.

- If you are concerned about the financial impact of being diagnosed with a critical illness and want to ensure you have the means to cover medical expenses and ongoing care, critical illness cover may be a priority.

Factors to Consider When Choosing Coverage

When deciding on life insurance and critical illness cover, there are several important factors to take into account that can greatly influence the type and level of coverage needed. Factors such as age, health status, lifestyle, and financial responsibilities play a crucial role in determining the appropriate coverage for each individual.

Age

Age is a significant factor to consider when choosing coverage as it can impact the cost of premiums and the type of coverage available. Generally, the younger you are when you take out a policy, the lower the premiums are likely to be.

Health Status

Your current health status is another key consideration. Pre-existing medical conditions can affect your eligibility for certain types of coverage and may result in higher premiums. It's important to disclose all relevant health information to ensure you get the right level of coverage.

Lifestyle

Your lifestyle choices, such as smoking, alcohol consumption, and participation in high-risk activities, can also impact the type of coverage you need. Insurers take these factors into consideration when assessing risk and determining premiums.

Financial Responsibilities

Your financial responsibilities, such as mortgage payments, debts, and dependents, should also be factored in when choosing coverage. The level of coverage needed will vary depending on your financial obligations and long-term financial goals.Assessing the appropriate level of coverage required involves evaluating these factors and determining the level of financial protection needed to safeguard your loved ones in the event of unforeseen circumstances.

It's essential to review your coverage regularly to ensure it aligns with your current life stage and financial situation.

Wrap-Up

In conclusion, Life Insurance and Critical Illness Cover play pivotal roles in safeguarding financial stability and peace of mind. By understanding their importance and differences, individuals can make informed choices to protect themselves and their loved ones.

Query Resolution

What are the key benefits of having Life Insurance?

Life insurance provides financial security for your loved ones in the event of your death, ensuring they are protected and can maintain their standard of living.

How does Critical Illness Cover differ from Life Insurance?

Critical Illness Cover provides a lump sum payment upon diagnosis of a specified illness, offering financial support during challenging times of illness.

What factors should I consider when choosing between Life Insurance and Critical Illness Cover?

Factors like your current health status, age, and financial responsibilities should influence your decision, as each type of coverage serves different purposes.