Exploring the intricacies of Home and Auto Insurance Bundle Quotes Explained, this introduction sets the stage for a deep dive into the topic. Providing valuable insights and information, this piece aims to educate and inform readers about the benefits and considerations of bundling home and auto insurance policies.

In the following paragraphs, we will delve into the factors that affect bundle quotes, understand coverage options, and offer tips for obtaining the best bundle quotes available in the market.

Introduction to Home and Auto Insurance Bundle Quotes

When it comes to protecting your assets and ensuring financial security, home and auto insurance are essential. Bundling these two types of insurance policies together can offer numerous advantages and cost-saving opportunities.

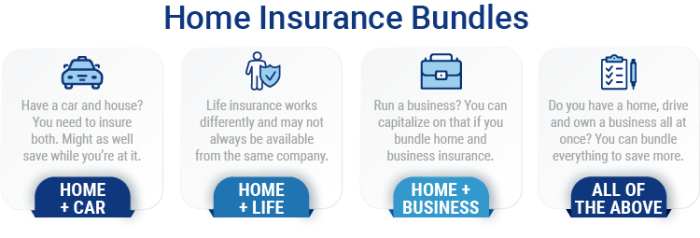

Define Home and Auto Insurance Bundles

Home and auto insurance bundles involve purchasing both your home insurance and auto insurance policies from the same insurance provider. Instead of buying these policies separately, bundling allows you to combine them into a single package.

Explain the Benefits of Bundling Home and Auto Insurance Policies

- Bundling home and auto insurance can lead to significant cost savings, as insurance companies often offer discounts for combining policies.

- Managing your insurance policies becomes more convenient with a bundle, as you only have to deal with one insurance provider for both home and auto coverage.

- Bundling can also simplify the claims process, making it easier and more efficient to file and resolve claims for both your home and auto insurance.

Share Why Individuals Consider Bundling Their Home and Auto Insurance

Many individuals choose to bundle their home and auto insurance to streamline their insurance coverage and save money in the process. By taking advantage of discounts and the convenience of a single provider, bundling can offer peace of mind and financial benefits for policyholders.

Factors Affecting Home and Auto Insurance Bundle Quotes

When it comes to determining the cost of a home and auto insurance bundle, several factors come into play. These factors can significantly impact the final quotes provided to the insured individual.

Location of the Insured Property

The location of the insured property plays a crucial role in determining the bundle quotes. Homes and vehicles located in high-crime areas or regions prone to natural disasters may lead to higher insurance premiums. Insurance companies take into account the risk associated with the location when calculating the quotes for a bundled policy.

Type and Age of the Home and Vehicle

The type and age of the home and vehicle being insured also influence the bundle quotes. Newer homes and vehicles with advanced safety features are generally associated with lower risks, resulting in lower insurance premiums. On the other hand, older properties and vehicles may come with higher insurance costs due to the increased likelihood of maintenance issues or accidents.

Insured’s Credit Score

The insured individual's credit score can have a significant impact on the bundle quotes provided by insurance companies. A higher credit score is often associated with responsible financial behavior, leading to lower insurance premiums. Conversely, individuals with lower credit scores may face higher insurance costs as they are perceived to be higher risk customers by the insurance providers.

Understanding Coverage Options in Home and Auto Insurance Bundles

When it comes to home and auto insurance bundles, understanding the coverage options available is crucial in making informed decisions to protect your assets and finances. Let's explore the common coverage options included in these bundled policies and compare them to standalone policies to see the advantages they offer.

Common Coverage Options

- Property Damage Coverage: This provides protection for damage to your home and belongings caused by covered perils like fire, theft, or vandalism.

- Liability Coverage: Protects you in case you are found legally responsible for injuries to others or damage to their property.

- Personal Injury Protection: Covers medical expenses for you and your passengers in case of an accident, regardless of fault.

- Collision Coverage: Pays for damage to your vehicle in case of a collision with another vehicle or object.

- Comprehensive Coverage: Protects your vehicle from non-collision incidents like theft, vandalism, or natural disasters.

Comparison with Standalone Policies

- Cost Efficiency: Bundling home and auto insurance can often lead to discounts and cost savings compared to purchasing separate policies.

- Convenience: Managing one policy for both home and auto insurance simplifies the process and reduces paperwork.

- Consistent Coverage: Bundled policies ensure that there are no coverage gaps or overlaps between your home and auto insurance.

Advantages of Bundled Coverage

- Multi-Policy Discount: Insurance companies often offer discounts for bundling policies, resulting in lower premiums overall.

- Single Deductible: In the event of a claim involving both your home and auto, you may only need to pay one deductible, saving you money.

- Enhanced Coverage Options: Some insurers provide additional benefits or coverage options exclusively for policyholders with bundled policies.

Tips for Obtaining the Best Home and Auto Insurance Bundle Quotes

When looking for the best home and auto insurance bundle quotes, it's essential to compare options from different insurers, qualify for discounts, and review coverage details carefully.

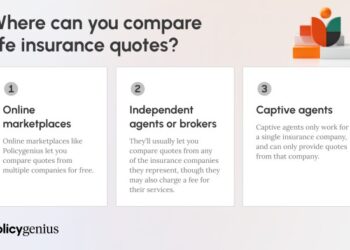

Shopping Around for the Best Bundle Quotes

- Obtain quotes from multiple insurance providers to compare prices and coverage options.

- Consider using online comparison tools to streamline the process and ensure you're getting the best deal.

- Don't hesitate to negotiate with insurers to see if they can offer a better rate to win your business.

Qualifying for Discounts When Bundling Insurance

- Ask insurers about available discounts for bundling home and auto policies together.

- Check if you qualify for other discounts based on factors like your driving record, home security features, or loyalty to the insurer.

- Consider increasing your deductibles to lower your premiums, but make sure you can afford the out-of-pocket costs if you need to make a claim.

Reviewing and Comparing Different Bundle Options

- Thoroughly review the coverage details of each bundle option to ensure it meets your needs and provides adequate protection.

- Compare not only the premiums but also the deductibles, coverage limits, and additional benefits offered by each insurer.

- Pay attention to any exclusions or limitations in the policies that could affect your coverage in specific situations.

Last Word

In conclusion, Home and Auto Insurance Bundle Quotes Explained sheds light on the importance of bundling insurance policies for cost savings and comprehensive coverage. By understanding the nuances of bundle quotes, individuals can make informed decisions to protect their assets effectively.

Commonly Asked Questions

What are home and auto insurance bundles?

Home and auto insurance bundles are packages that combine both home and auto insurance policies into one, offering convenience and potential cost savings.

How does the insured property's location impact bundle quotes?

The location of the insured property can affect bundle quotes due to varying risks associated with different areas, such as crime rates and natural disaster likelihood.

What are some common coverage options in home and auto insurance bundles?

Common coverage options include liability coverage, property damage coverage, personal injury protection, and comprehensive coverage for both home and auto insurance.

How can one qualify for discounts when bundling home and auto insurance?

To qualify for discounts, individuals can typically combine policies from the same insurer, have a good credit score, and maintain a claims-free history.

What are some tips for reviewing and comparing different bundle options from insurers?

When reviewing bundle options, it's essential to compare coverage limits, deductibles, premiums, and any additional benefits offered by insurers to make an informed choice.