Exploring Discount Car Insurance Quotes for Young Drivers in the UK, this introduction sets the stage for a detailed examination of the topic, providing valuable insights and practical advice in a clear and engaging manner.

The subsequent paragraph will delve deeper into the specifics of car insurance for young drivers in the UK, shedding light on key factors and strategies to secure discounted quotes.

Factors Affecting Car Insurance Quotes for Young Drivers in the UK

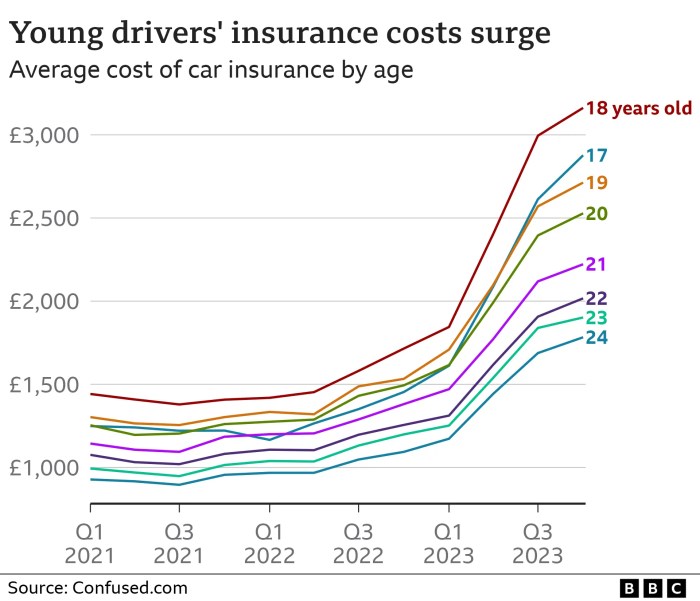

When it comes to car insurance for young drivers in the UK, several key factors play a significant role in determining the cost of premiums. Factors such as age, driving experience, vehicle type, and location can heavily influence insurance quotes, making it essential for young drivers to understand how these elements impact their insurance costs.

Age

Age is a crucial factor in determining car insurance quotes for young drivers in the UK. Typically, younger drivers under the age of 25 are considered higher risk by insurance companies due to their lack of driving experience. As a result, insurance premiums for young drivers are often higher compared to older, more experienced drivers.

Driving Experience

Driving experience is another critical factor that affects car insurance quotes for young drivers. Insurance companies view individuals with limited driving experience as higher risk, leading to higher insurance premiums. Young drivers who have recently obtained their driving license may face higher costs until they build a history of safe driving.

Vehicle Type

The type of vehicle young drivers choose to insure also impacts their insurance quotes. High-performance cars, luxury vehicles, or cars with expensive repair costs typically result in higher insurance premiums. Opting for a more modest and practical vehicle can help young drivers secure more affordable insurance rates.

Location

The location where a young driver resides can significantly influence their car insurance quotes. Urban areas with higher rates of traffic congestion, accidents, and theft may result in higher insurance premiums compared to rural locations with lower risk factors. Young drivers should consider their location when seeking insurance coverage.

Gender and Additional Driver Features

In the UK, gender can still play a role in determining car insurance quotes for young drivers, although the impact has lessened in recent years. Additionally, features such as adding another driver to the policy, choosing a higher excess, or installing security devices in the vehicle can also affect insurance premiums for young drivers.

Strategies to Obtain Discounted Car Insurance Quotes for Young Drivers in the UK

Young drivers in the UK often face high car insurance premiums due to their lack of driving experience. However, there are several strategies they can implement to lower these costs and obtain discounted quotes.Adding a telematics device to the vehicle is one effective way to potentially reduce insurance premiums.

These devices track driving behavior, such as speed, braking, and cornering, allowing insurance companies to tailor quotes based on individual driving habits.

Take Advanced Driving Courses

One way for young drivers to lower their insurance costs is by taking advanced driving courses. These courses can improve driving skills and demonstrate to insurers that the driver is committed to safe driving practices, potentially leading to discounted quotes.

Consider Increasing Voluntary Excess or Opting for Black Box Insurance

Increasing the voluntary excess, which is the amount the driver agrees to pay towards a claim, can result in lower insurance premiums. Opting for black box insurance, where a telematics device is installed in the vehicle, can also lead to cheaper quotes by rewarding safe driving behavior.

Comparison of Insurance Providers Offering Discounted Quotes for Young Drivers in the UK

When it comes to finding discounted car insurance quotes for young drivers in the UK, comparing different insurance providers is crucial. Each insurer may offer unique discounts and criteria for eligibility, so it's essential to explore your options thoroughly to find the best deal.

Discounts and Criteria by Insurance Providers

- Company A: Offers a discount for young drivers with a clean driving record and completion of a defensive driving course.

- Company B: Provides a discount for students with good grades and low mileage usage.

- Company C: Offers a discount for young drivers who install a telematics device to monitor their driving habits.

Process of Obtaining and Comparing Quotes

- Request quotes from multiple insurance providers online or through an agent.

- Provide the necessary information, such as your age, driving history, and vehicle details, to get accurate quotes.

- Compare the coverage options, discounts, and overall costs of each quote to determine the best offer.

- Consider factors like customer service, reputation, and ease of claims processing when evaluating insurance providers.

Understanding the Legal Requirements and Coverage Options for Young Drivers in the UK

As a young driver in the UK, it is essential to understand the legal requirements and coverage options when it comes to car insurance. This knowledge will help you make informed decisions and ensure you have the necessary protection while on the road.

Minimum Legal Requirements for Car Insurance in the UK

In the UK, all drivers are legally required to have at least third-party car insurance. This type of insurance covers the cost of damage or injury to other people, vehicles, or property in the event of an accident that is deemed your fault.

- Third-party insurance is the minimum legal requirement and does not cover any damage to your own vehicle.

- Driving without insurance is a serious offense that can result in fines, penalty points on your license, or even disqualification from driving.

Types of Coverage Options Available

Aside from third-party insurance, young drivers in the UK have other coverage options to choose from based on their needs and budget.

- Comprehensive Insurance:This type of insurance provides the highest level of coverage, including damage to your own vehicle in addition to third-party coverage.

- Black Box Insurance:Also known as telematics insurance, this option involves installing a black box in your car to monitor your driving behavior. Safe driving can lead to lower premiums.

Importance of Understanding Policy Terms and Conditions

It is crucial for young drivers to carefully read and understand the terms and conditions of their insurance policy to avoid any surprises in the event of a claim.

- Be aware of any excess payments you may need to make in the event of a claim.

- Understand any restrictions or limitations on your policy, such as mileage caps or usage of the vehicle.

Last Recap

In conclusion, this discussion has highlighted the importance of understanding the nuances of car insurance for young drivers in the UK, offering guidance on how to navigate the complexities of obtaining affordable quotes.

General Inquiries

What factors influence car insurance costs for young drivers?

Factors such as age, driving experience, vehicle type, and location can significantly impact insurance quotes for young drivers.

How can young drivers obtain discounted insurance quotes in the UK?

Young drivers can lower insurance costs by taking advanced driving courses, using telematics devices for potential discounts, or opting for black box insurance.

What are some tips for comparing insurance providers offering discounts to young drivers in the UK?

To find the best deal, compare different insurance companies, analyze their specific discounts, and understand the criteria used to determine eligibility for discounted rates.

What are the legal requirements for car insurance for young drivers in the UK?

Young drivers in the UK must meet the minimum legal requirements for car insurance, which include third-party coverage at the very least.

Why is it important for young drivers to understand policy terms and conditions?

Understanding policy terms and conditions is crucial for young drivers to make informed decisions about their coverage options and ensure they are adequately protected.