Exploring the realm of Cheap General Liability Insurance for Contractors: How to Find It, this introduction sets the stage for a captivating journey through the intricacies of insurance acquisition.

Providing insights into the various aspects of insurance costs and strategies to reduce them, this discussion aims to empower contractors in making informed decisions.

Factors affecting the cost of general liability insurance for contractors

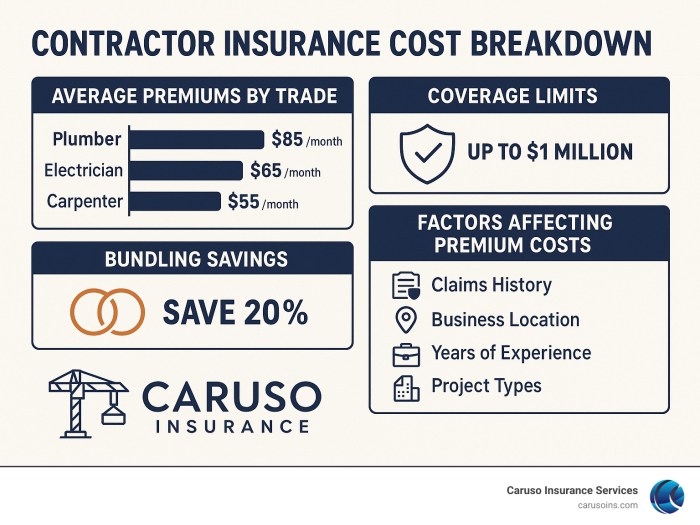

When it comes to determining the cost of general liability insurance for contractors, several factors come into play. Understanding these factors can help contractors make informed decisions when choosing the right insurance coverage for their business.

Business Size, Location, and Type of Work

The size of a contractor's business, their location, and the type of work they perform can all impact the cost of general liability insurance. Larger businesses with more employees and higher revenue may face higher premiums. Additionally, contractors working in high-risk locations or engaging in riskier activities may also see increased insurance costs.

Risk Assessment and Claims History

Insurance companies assess the level of risk associated with a contractor's business when determining premiums. A contractor with a history of frequent claims or lawsuits may be viewed as a higher risk, leading to higher insurance costs. It is essential for contractors to maintain a strong safety record and minimize claims to keep insurance premiums affordable.

High-Risk Activities

Engaging in high-risk activities such as roofing, demolition, or working at extreme heights can significantly impact insurance costs for contractors. These activities are more prone to accidents and injuries, leading to higher premiums to mitigate potential risks for insurance companies.

Coverage Limits and Deductibles

The coverage limits and deductibles chosen by a contractor can also influence the price of general liability insurance. Higher coverage limits and lower deductibles typically result in higher premiums, as they offer more extensive protection in the event of a claim.

Contractors should carefully consider their coverage needs and budget when selecting these limits to find the right balance between protection and affordability.

Strategies to reduce the cost of general liability insurance for contractors

When it comes to reducing the cost of general liability insurance for contractors, there are several strategies that can be employed to help lower premiums and save money in the long run.Maintaining a safe work environment is essential for minimizing risks and reducing insurance costs.

By implementing strict safety protocols and ensuring that all employees follow proper safety procedures, contractors can lower the likelihood of accidents and claims, ultimately leading to lower insurance expenses.

Proactive Risk Mitigation Measures

- Regularly conduct safety training sessions for all employees to ensure they are aware of potential hazards and how to mitigate them.

- Implement strict quality control measures to reduce the chances of errors or defects that could lead to liability claims.

- Invest in proper equipment maintenance to prevent accidents caused by faulty machinery or tools.

- Keep detailed records of all safety procedures and incident reports to demonstrate a commitment to safety in case of an insurance claim.

Bundle Insurance Policies and Seek Discounts

- Consider bundling general liability insurance with other policies, such as property insurance or commercial auto insurance, to potentially receive a discount on overall premiums.

- Shop around and compare quotes from multiple insurance providers to find the best rates and discounts available for contractors.

- Ask your insurance agent about available discounts for factors like a good safety record, certifications, or membership in professional organizations.

- Regularly review and update your insurance coverage to ensure you are not paying for unnecessary or redundant coverage that can drive up costs.

Where to find affordable general liability insurance for contractors

Finding affordable general liability insurance for contractors can be a crucial step in managing business expenses while ensuring adequate coverage. Here are some strategies to help you find the best insurance options tailored to your needs.

Compare different insurance providers and their offerings for contractors

- Research and compare quotes from multiple insurance companies specializing in coverage for contractors.

- Consider factors such as coverage limits, deductibles, and additional services offered by each provider.

- Look for providers with experience in working with contractors to ensure they understand the unique risks and challenges in the industry.

Benefits of working with specialized insurance companies for contractors

- Specialized insurance companies often offer tailored policies designed specifically for contractors, providing comprehensive coverage at competitive rates.

- These companies may have a better understanding of the risks associated with the construction industry, allowing them to offer more suitable coverage options.

- Working with a specialized insurer can provide access to additional resources and support to help manage risks effectively.

Leverage industry associations or trade groups for exclusive insurance deals

- Joining industry associations or trade groups can provide access to group insurance plans that offer discounted rates for members.

- These organizations often have partnerships with insurance providers, allowing members to benefit from exclusive deals and specialized coverage options.

- Take advantage of networking opportunities within these groups to gather insights and recommendations on the best insurance options available for contractors.

Process of obtaining quotes from multiple insurers to compare prices and coverage options

- Reach out to different insurance companies to request quotes based on your specific business needs and coverage requirements.

- Provide detailed information about your contracting business to ensure accurate quotes that reflect the risks associated with your operations.

- Compare quotes from various insurers, taking into account both the cost of premiums and the extent of coverage offered to make an informed decision.

Common mistakes to avoid when searching for cheap general liability insurance

When looking for affordable general liability insurance as a contractor, it's crucial to steer clear of common pitfalls that could lead to inadequate coverage or unexpected costs. Understanding the following mistakes to avoid can help you make informed decisions when selecting insurance options.

Importance of understanding policy exclusions and limitations

Before purchasing general liability insurance, it's essential to thoroughly review the policy exclusions and limitations. Failure to understand these aspects could result in gaps in coverage when you need it most. Make sure you are aware of what is included and excluded in your policy to avoid surprises in the event of a claim.

Reviewing insurance contracts thoroughly

Contractors should take the time to review insurance contracts carefully to identify any hidden fees or inadequate coverage. By thoroughly examining the terms and conditions of the policy, you can ensure that you are getting the coverage you need at a reasonable cost.

Don't overlook the details in the contract that could impact your coverage in the long run.

Pitfalls of opting for the cheapest insurance option

While finding affordable insurance is important, opting for the cheapest option may not always be the best decision. In some cases, lower-priced policies may come with higher deductibles, lower coverage limits, or exclusions that leave you vulnerable to risks. It's crucial to strike a balance between cost and coverage to ensure you are adequately protected without compromising on quality.

Concluding Remarks

In conclusion, navigating the landscape of cheap general liability insurance for contractors requires diligence and awareness of key factors. By following the Artikeld strategies and avoiding common mistakes, contractors can secure the most suitable insurance coverage for their needs.

General Inquiries

What factors can impact the cost of general liability insurance for contractors?

Factors such as business size, location, type of work, and claims history can all play a role in determining insurance costs for contractors.

How can contractors reduce the cost of general liability insurance?

Contractors can lower insurance premiums by mitigating risks, maintaining a safe work environment, taking proactive measures to minimize claims, and seeking discounts or bundled policies.

Where can contractors find affordable general liability insurance?

Contractors can compare offerings from different insurance providers, work with specialized companies catering to their needs, leverage industry associations for exclusive deals, and obtain quotes from multiple insurers for price and coverage comparisons.

What are common mistakes to avoid when searching for cheap general liability insurance?

Contractors should be wary of pitfalls, understand policy exclusions and limitations, review insurance contracts thoroughly, and consider long-term implications rather than opting for the cheapest option.