Delving into the realm of Automotive Insurance Quote Tips for Better Coverage, this piece aims to provide valuable insights in a manner that captivates and informs.

Exploring the intricacies of automotive insurance coverage, factors influencing insurance quotes, and tips for obtaining better coverage, this guide is designed to enhance your understanding and decision-making process.

Importance of Automotive Insurance Coverage

Having adequate automotive insurance coverage is crucial to protect yourself, your vehicle, and others in case of an accident or unforeseen event on the road.

Different Types of Coverage

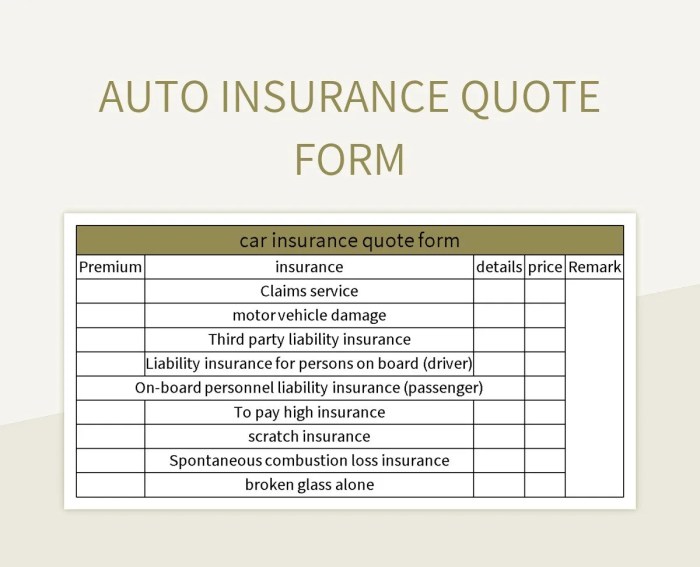

- Liability Coverage: This type of coverage helps pay for damage or injuries to others if you are at fault in an accident.

- Collision Coverage: This coverage helps pay for repairs to your vehicle if it is damaged in a collision with another vehicle or object.

- Comprehensive Coverage: Comprehensive coverage helps pay for repairs or replacement of your vehicle if it is stolen or damaged by something other than a collision, such as vandalism, fire, or natural disasters.

- Uninsured/Underinsured Motorist Coverage: This coverage protects you if you are involved in an accident with a driver who does not have insurance or enough insurance to cover your expenses.

Consequences of Being Underinsured

Being underinsured can lead to significant financial difficulties in the event of an accident. If your coverage limits are not sufficient to cover the costs of damages or injuries, you may be personally responsible for paying the remaining expenses out of pocket.

This can result in financial strain, legal issues, and potential loss of assets.

Factors Influencing Automotive Insurance Quotes

When it comes to getting an automotive insurance quote, there are several factors that insurance companies take into consideration to determine the cost of your premium. Understanding these factors can help you make informed decisions to potentially lower your insurance costs.

Age

Age is a significant factor that influences automotive insurance quotes. Younger drivers, especially teenagers, tend to pay higher premiums due to their lack of driving experience and higher likelihood of being involved in accidents. On the other hand, older drivers with more driving experience may receive lower insurance quotes.

Driving Record

Your driving record plays a crucial role in determining your insurance premium. If you have a history of traffic violations, accidents, or DUI convictions, you can expect to pay more for insurance coverage. On the contrary, drivers with a clean record are often eligible for lower premiums.

Location

Where you live can also impact your automotive insurance quotes. Urban areas with high traffic congestion and crime rates typically have higher insurance premiums compared to rural areas. Additionally, areas prone to natural disasters or high rates of car theft may result in increased insurance costs.

Type of Vehicle

The type of vehicle you drive can affect your insurance premium as well. Sports cars, luxury vehicles, and high-performance cars typically come with higher insurance rates due to their increased risk of accidents and theft. On the other hand, more affordable and safe vehicles may result in lower insurance costs.Overall, by understanding how age, driving record, location, and type of vehicle influence automotive insurance quotes, you can take steps to potentially lower your insurance costs.

Maintaining a clean driving record, choosing a safer vehicle, and living in a low-risk area are some ways to help reduce your insurance premiums.

Tips for Getting Better Coverage

When it comes to automotive insurance coverage, there are several strategies you can implement to ensure you have the best protection possible. Tailoring your coverage to your specific needs and risks is crucial, and regularly reviewing and updating your policy can make a significant difference in the level of coverage you receive.

1. Understand Your Coverage Needs

- Assess your driving habits, the value of your vehicle, and your financial situation to determine the level of coverage you need.

- Consider factors like your daily commute, the area you live in, and any additional drivers in your household.

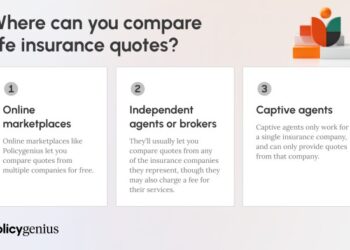

2. Compare Multiple Quotes

- Shop around and compare quotes from different insurance providers to ensure you are getting the best possible coverage at a competitive price.

- Consider bundling your auto insurance with other policies, such as home or renter's insurance, for potential discounts.

3. Opt for Higher Deductibles

- Choosing a higher deductible can lower your premiums, but make sure you can afford the out-of-pocket costs in case of an accident.

- Evaluate your financial situation and weigh the pros and cons of a higher deductible for better coverage.

4. Consider Additional Coverage Options

- Explore options like comprehensive coverage, uninsured/underinsured motorist coverage, and roadside assistance to enhance your protection.

- Assess your specific needs and risks to determine which additional coverage options are worth investing in.

5. Review and Update Your Policy Regularly

- Regularly review your policy to ensure it still meets your needs and provides adequate coverage based on any life changes or new risks.

- Contact your insurance provider to make any necessary updates or modifications to your policy for better coverage.

Understanding Insurance Policy Terms

When it comes to automotive insurance policies, understanding the terms used is crucial for making informed decisions about coverage. Common terms like deductible, premium, and coverage limits play a significant role in determining the level of protection you have and the costs involved.

Deductible

The deductible is the amount you agree to pay out of pocket before your insurance coverage kicks in. For example, if you have a $500 deductible and your car sustains $1,000 in damage in an accident, you would pay $500, and your insurance would cover the remaining $500.

Choosing a higher deductible typically lowers your premium but increases your out-of-pocket expenses in the event of a claim.

Premium

Your premium is the amount you pay to the insurance company for your coverage. It is typically paid monthly, quarterly, or annually. Factors like your driving record, age, location, and the type of car you drive can influence your premium.

It's important to balance the cost of your premium with the coverage it provides to ensure you are adequately protected.

Coverage Limits

Coverage limits refer to the maximum amount your insurance company will pay for a covered claim. For example, if you have liability coverage with limits of $50,000/$100,000, this means your insurer will pay up to $50,000 per person and $100,000 per accident for bodily injury liability.

It's essential to review your coverage limits to make sure they align with your financial assets and potential liabilities.

Ultimate Conclusion

In conclusion, Automotive Insurance Quote Tips for Better Coverage equips you with the knowledge needed to navigate the complex landscape of insurance policies, ensuring you make informed choices that secure your assets and well-being.

Q&A

What factors can influence the cost of automotive insurance quotes?

Factors such as age, driving record, location, and type of vehicle can all impact insurance premiums. Insurers consider these variables when calculating quotes.

How often should I review and update my automotive insurance coverage?

It's advisable to review and update your coverage annually or whenever there are significant changes in your driving habits, vehicle, or life circumstances. Regular reviews ensure your coverage remains adequate.

What are some common terms found in automotive insurance policies?

Common terms include deductible (the amount you pay before insurance kicks in), premium (the cost of your insurance policy), and coverage limits (the maximum amount your insurer will pay for covered claims).