Starting with Business Travel Insurance 101: What Every Frequent Flyer Needs, this introductory paragraph aims to grab the readers' attention and provide an insightful overview of the topic.

The subsequent paragraph will delve into the specifics of the subject matter, offering detailed information.

Introduction to Business Travel Insurance

Business travel insurance is a crucial aspect for frequent flyers as it provides financial protection and peace of mind during work-related trips. Whether you're traveling domestically or internationally, having the right insurance coverage can make a significant difference in unforeseen situations.

Key Benefits of Business Travel Insurance

- Medical Coverage: Business travel insurance often includes medical coverage for emergencies, ensuring you receive the necessary medical attention without worrying about expenses.

- Trip Cancellation/Interruption: In case your trip gets canceled or interrupted due to unforeseen circumstances, such as a sudden illness or a natural disaster, travel insurance can reimburse you for the non-refundable costs.

- Lost or Delayed Baggage: If your luggage gets lost or delayed during transit, business travel insurance can help cover the costs of replacing essential items until your belongings are recovered.

Scenarios Where Business Travel Insurance Can Be a Lifesaver

- Medical Emergency Abroad: Imagine falling ill or getting injured while on a business trip in a foreign country. Business travel insurance can assist in navigating the local healthcare system and covering medical expenses.

- Flight Cancellation: Flights can get canceled or delayed due to various reasons beyond your control. With travel insurance, you can receive compensation for the inconvenience and arrange alternative travel arrangements.

- Business Equipment Loss: If your essential work equipment, such as a laptop or presentation materials, gets damaged or stolen during your trip, business travel insurance can help cover the replacement costs.

Types of Coverage

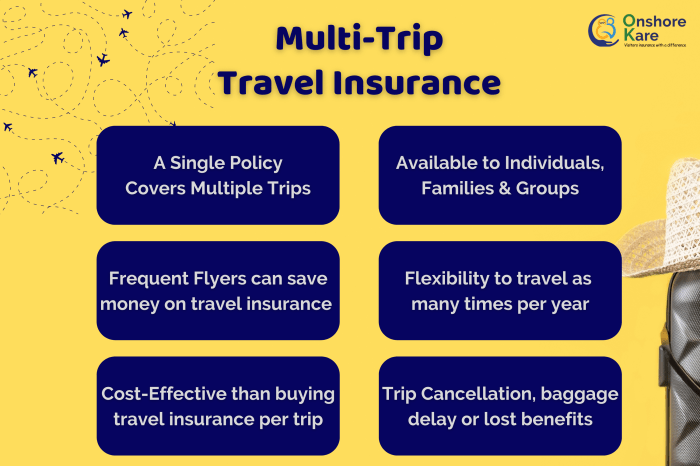

When it comes to business travel insurance, there are different types of coverage options available to cater to the needs of frequent flyers. Let's explore the basic coverage versus premium coverage options and delve into specific incidents where each type of coverage would be beneficial.

Basic Coverage

Basic coverage typically includes essential protections such as trip cancellation, trip interruption, and travel delays. For instance, if your flight is canceled due to inclement weather or a sudden illness prevents you from traveling, basic coverage would help reimburse you for any non-refundable expenses incurred.

Premium Coverage

Premium coverage, on the other hand, offers a wider range of benefits and higher coverage limits compared to basic plans. This may include additional coverage for lost baggage, emergency medical expenses, and even rental car insurance. In a scenario where your luggage is lost during a business trip or you require medical treatment abroad, premium coverage would provide comprehensive assistance and financial support.

Key Features to Consider

When choosing a business travel insurance policy, there are key features that frequent flyers should prioritize to ensure comprehensive coverage and peace of mind during their trips. Here is a checklist of must-have features for frequent business travelers:

1. Trip Cancellation and Interruption Coverage

One of the most essential features to look for in a business travel insurance policy is trip cancellation and interruption coverage. This feature provides reimbursement for non-refundable trip expenses in case your trip is canceled or interrupted due to covered reasons such as illness, injury, or natural disasters.

2. Emergency Medical Assistance

Another important feature to consider is emergency medical assistance coverage. This feature ensures that you have access to medical assistance and emergency services while traveling for business, including coverage for medical expenses, evacuation, and repatriation.

3. Baggage and Personal Belongings Coverage

Baggage and personal belongings coverage is crucial for frequent flyers who travel with valuable items for business purposes. This feature provides reimbursement for lost, stolen, or damaged baggage, as well as coverage for personal belongings such as laptops, phones, and business documents.

4. Travel Delay and Missed Connection Coverage

Travel delay and missed connection coverage is important for business travelers who rely on punctual travel arrangements. This feature offers compensation for additional expenses incurred due to travel delays, missed connections, or itinerary changes beyond your control.

5. 24/7 Travel Assistance Services

Having access to 24/7 travel assistance services is a valuable feature for frequent business travelers. This service provides round-the-clock support for travel-related emergencies, such as lost passports, flight rebooking, or medical referrals, ensuring that you have assistance whenever and wherever you need it.

Claim Process and Documentation

When it comes to business travel insurance, understanding the claim process and having the right documentation in place is crucial for a smooth experience. In this section, we will walk you through the step-by-step process of filing a claim, guide you on the required documentation, and share tips on expediting the claim process for busy business travelers.

Step-by-Step Guide for Filing a Claim

- Notify your insurance provider immediately: As soon as an incident occurs that may result in a claim, inform your insurance provider at the earliest.

- Fill out the claim form: Your insurance provider will provide you with a claim form that needs to be completed accurately and thoroughly.

- Submit supporting documents: Along with the claim form, you will need to provide supporting documents such as receipts, medical records, police reports, and any other relevant paperwork.

- Wait for claim assessment: Once you have submitted all required documents, your insurance provider will assess the claim and communicate their decision to you.

- Receive payment: If your claim is approved, you will receive the payment as per the terms of your policy.

Documentation Required for Claim Processing

- Copies of travel itinerary and tickets

- Receipts for expenses incurred due to the incident

- Medical records and bills in case of medical emergencies

- Police reports for incidents like theft or loss of belongings

- Any other relevant documentation as requested by your insurance provider

Tips to Expedite the Claim Process

- Keep all your documentation organized and easily accessible

- Submit your claim as soon as possible to avoid delays

- Follow up with your insurance provider regularly for updates on your claim

- Provide all necessary information and documents promptly to expedite the process

- Consider opting for electronic submission of documents for faster processing

Coverage Exclusions and Limitations

Business travel insurance policies often come with certain exclusions and limitations that travelers need to be aware of to avoid unexpected situations. These exclusions and limitations can vary depending on the insurance provider and policy, so it's essential to thoroughly review the terms and conditions before purchasing coverage.

Common Exclusions and Limitations

- Pre-existing medical conditions may not be covered under the policy, unless specifically stated otherwise.

- Activities like extreme sports or high-risk adventures may not be covered, so additional coverage may be required.

- Losses due to acts of war or terrorism may be excluded from coverage.

Real-life Examples

- If a traveler falls ill due to a pre-existing condition during a business trip and it's not covered, they may have to bear all medical expenses.

- If a traveler decides to go skydiving during their trip and gets injured, the medical costs may not be covered by the insurance policy due to the high-risk nature of the activity.

Ways to Mitigate Risks

- Read the policy documents carefully to understand the exclusions and limitations before traveling.

- Purchase additional coverage for specific activities or items that are not covered under the standard policy.

- Stay informed about travel advisories and potential risks in the destination to take necessary precautions.

Ultimate Conclusion

Concluding with a compelling summary, this paragraph wraps up the discussion on a high note, leaving readers with valuable insights.

FAQ Corner

What does business travel insurance typically cover?

Business travel insurance usually covers trip cancellation, medical emergencies, lost luggage, and other travel-related incidents.

Is business travel insurance necessary for frequent flyers?

Yes, business travel insurance is crucial for frequent flyers as it provides financial protection and assistance in emergencies during trips.

How can one expedite the claim process with business travel insurance?

To speed up the claim process, ensure you have all necessary documentation, submit claims promptly, and follow up with the insurance provider.