Full Coverage Insurance Quotes: What You Should Know sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail and brimming with originality from the outset.

As we delve into the world of full coverage insurance, we uncover essential insights that can guide you towards making informed decisions about your insurance needs.

Introduction to Full Coverage Insurance Quotes

When it comes to protecting your assets and ensuring financial security in case of unforeseen events, full coverage insurance plays a crucial role. Full coverage insurance refers to a comprehensive insurance policy that includes a wide range of coverages to protect you and your belongings in various situations.

Components of Full Coverage Insurance

Full coverage insurance typically includes components such as:

- Liability coverage, which helps cover costs in case you're responsible for causing property damage or injuries to others.

- Collision coverage, which pays for repairs to your own vehicle in case of an accident, regardless of fault.

- Comprehensive coverage, which protects your vehicle from non-collision damages like theft, vandalism, or natural disasters.

Situations Where Full Coverage Insurance is Recommended

Full coverage insurance is recommended in various scenarios, such as:

- Owning a new or valuable vehicle that you want to protect from potential damages.

- Living in an area prone to natural disasters or high rates of vehicle theft.

- Having a lease or loan on your vehicle that requires full coverage insurance as a condition.

Factors Influencing Full Coverage Insurance Quotes

When it comes to obtaining full coverage insurance quotes, several factors come into play that can impact the final cost. Factors such as age, location, driving history, type of vehicle, coverage limits, and deductibles all play a crucial role in determining the insurance premium you may have to pay.

Personal Factors: Age, Location, and Driving History

- Your age can significantly influence your insurance quotes. Typically, younger drivers tend to face higher premiums due to their lack of driving experience and higher likelihood of accidents.

- Where you live also matters. Urban areas with higher rates of accidents and theft may result in higher insurance costs compared to rural areas.

- Your driving history, including past accidents and traffic violations, can impact your insurance rates. A clean driving record usually means lower premiums.

Type of Vehicle Impact

- The make and model of your vehicle can affect your insurance quotes. Expensive cars or models with high theft rates may lead to higher premiums.

- Safety features, such as anti-theft devices or airbags, can potentially lower your insurance costs by reducing the risk of theft or injuries in case of an accident.

Coverage Limits and Deductibles

- The coverage limits you choose play a role in determining your insurance costs. Higher coverage limits provide more protection but also result in higher premiums.

- Deductibles, the amount you pay out of pocket before insurance kicks in, can also impact your quotes. Opting for a higher deductible can lower your premiums, but you'll have to pay more in case of a claim.

Obtaining Full Coverage Insurance Quotes

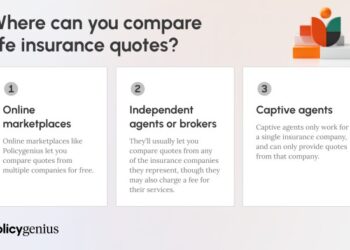

When looking to obtain full coverage insurance quotes, there are several methods you can use to gather information from different insurance providers. Each method has its own advantages and considerations to keep in mind.

Comparing Different Methods of Obtaining Quotes

- Online Platforms: Many insurance companies offer online platforms where you can input your information and receive quotes instantly. These platforms are convenient and allow you to compare multiple quotes at once.

- Agents: Working with an insurance agent can provide you with personalized assistance and guidance in selecting the right coverage. Agents can also help you navigate complex insurance terms and options.

- Phone Calls: Contacting insurance companies directly via phone can also help you obtain quotes. This method allows for direct communication with a representative who can answer any questions you may have.

Tip: When comparing quotes from different providers, make sure you are comparing the same coverage options and limits. Take note of any additional benefits or discounts offered by each provider

.

Understanding Full Coverage Insurance Costs

When it comes to full coverage insurance, understanding the costs involved is crucial. Let's break down the components that contribute to the cost of full coverage insurance, delve into the concept of premiums, and explore additional fees or discounts that may impact the overall cost.

Components of Full Coverage Insurance Costs

- The type of coverage you choose: The extent of coverage you opt for, whether it includes comprehensive, collision, liability, or other types, will affect the overall cost.

- Your driving record: Your driving history, including any past accidents or traffic violations, can influence how much you pay for full coverage insurance.

- The make and model of your vehicle: The value of your car, its safety features, and the likelihood of theft or damage can all impact the cost of insurance.

Calculation of Premiums

Insurance premiums are the amount you pay for coverage, typically on a monthly or annual basis. They are calculated based on various factors, including your age, location, driving history, and the type of coverage you choose. Insurance companies also take into account the risk associated with insuring you and your vehicle when determining your premiums.

Additional Fees and Discounts

- Additional fees: Some insurance companies may charge extra fees for services like monthly payments, paper statements, or processing fees. Make sure to inquire about any additional costs when getting a quote.

- Discounts: Insurance companies often offer discounts for safe driving, bundling policies, having anti-theft devices in your car, or being a loyal customer. Taking advantage of these discounts can help lower the overall cost of full coverage insurance.

Importance of Reviewing Full Coverage Insurance Quotes

When it comes to choosing full coverage insurance, reviewing quotes carefully is essential to ensure you make an informed decision that meets your needs and budget.

Understanding the Terms and Conditions

Before selecting a full coverage insurance policy, it is crucial to thoroughly review the terms and conditions Artikeld in the insurance quotes. Pay close attention to coverage limits, deductibles, exclusions, and any additional features or benefits offered by each insurance provider.

- Take note of any specific conditions or requirements that may affect your coverage in the event of a claim.

- Compare the terms of each quote to determine which policy offers the most comprehensive coverage for your individual needs.

Tips for Effective Comparison

When comparing full coverage insurance quotes, consider the following tips to help you choose the best option:

- Request quotes from multiple insurance providers to have a broader range of options to compare.

- Ensure that you are comparing similar coverage levels and deductibles to make an accurate assessment.

- Look for any discounts or special offers that may be available to help lower the overall cost of the policy.

- Take into account the reputation and customer service record of each insurance company to gauge their reliability.

Ultimate Conclusion

In conclusion, Full Coverage Insurance Quotes: What You Should Know serves as a valuable resource for navigating the complexities of insurance coverage, empowering you to secure the best protection for your assets and peace of mind.

Essential FAQs

What factors can influence full coverage insurance quotes?

Factors such as age, location, driving history, type of vehicle, coverage limits, and deductibles can all impact insurance quotes.

How can I obtain full coverage insurance quotes?

You can obtain quotes from insurance companies through online platforms, agents, or phone calls. Make sure to compare quotes accurately for the best option.

Why is it important to review full coverage insurance quotes carefully?

Reviewing quotes carefully helps in understanding terms, conditions, and costs, ensuring you choose the most suitable coverage for your needs.