With Bundle Insurance Quotes: How to Save More in 2025 at the forefront, this paragraph opens a window to an amazing start and intrigue, inviting readers to embark on a storytelling filled with unexpected twists and insights.

Exploring the importance of bundle insurance quotes, factors affecting costs, tips for saving more in 2025, and future trends in the industry will provide a comprehensive understanding of how to maximize savings.

Importance of Bundle Insurance Quotes

When it comes to managing your finances, saving money wherever possible is always a smart move. One effective way to cut down on expenses is by bundling your insurance policies together.

Types of Insurance You Can Bundle

- Home and Auto Insurance

- Life and Health Insurance

- Renters and Auto Insurance

By bundling these policies, you can enjoy significant cost savings and streamline your insurance management.

Advantages of Bundle Insurance Quotes

- Discounts: Insurance companies often offer discounts for bundling policies, leading to lower overall premiums.

- Convenience: Managing multiple policies with a single insurer is more convenient and less time-consuming.

- Simplified Claims Process: Dealing with a single insurer for multiple policies can make the claims process smoother and more efficient.

- Enhanced Coverage: Some insurers offer additional benefits or enhanced coverage options for policy bundles.

Factors Affecting Bundle Insurance Costs

When it comes to bundle insurance costs, several factors come into play that can influence the overall price you pay for your policies. Understanding these factors can help you make informed decisions when bundling your insurance.

Number of Policies Bundled

- The number of policies you bundle together can have a significant impact on the overall cost. Insurance companies often offer discounts for bundling multiple policies, such as auto and home insurance.

- By bundling more policies together, you may be eligible for higher discounts, resulting in lower overall costs compared to purchasing individual policies separately.

Personal Factors

- Personal factors like age, location, and driving record can also affect bundle insurance costs. Younger drivers or individuals living in high-risk areas may face higher premiums.

- Insurance companies consider these personal factors when determining pricing for bundled policies, as they assess the level of risk associated with each policyholder.

Insurance Companies Pricing

- Insurance companies use a variety of factors to determine pricing for bundled policies, including the level of coverage, deductibles, and the type of policies being bundled.

- Companies also consider external factors such as market trends, competition, and claims history when setting prices for bundled insurance packages.

Tips for Saving More in 2025

In order to maximize your savings on bundle insurance quotes in 2025, consider the following strategies and tips.

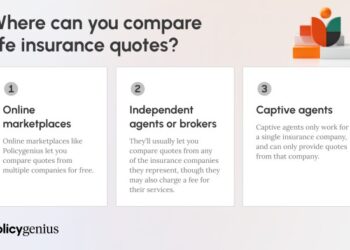

Compare Bundle Offers from Different Insurance Providers

When looking to save more on your insurance policies, it is important to compare bundle offers from various insurance providers. Each provider may have different discounts and packages available, so take the time to research and compare to find the best deal for your specific needs

Utilize Online Tools and Technology

Take advantage of technology and online tools to compare bundle insurance quotes easily and efficiently. Many insurance comparison websites allow you to input your information once and receive quotes from multiple providers, making it simple to find the most cost-effective option for your insurance needs.

Bundle Multiple Policies

One of the most effective ways to save on insurance premiums is to bundle multiple policies with the same provider. By combining your auto, home, and other insurance policies, you can often qualify for significant discounts on your overall premium costs.

Maintain a Good Credit Score

Insurance companies often take your credit score into account when determining your premium rates. By maintaining a good credit score, you may be able to secure lower rates on your bundle insurance policies.

Review and Update Your Coverage Regularly

To ensure that you are getting the best deal on your bundle insurance policies, it is important to review and update your coverage regularly. As your circumstances change, you may be eligible for additional discounts or need to adjust your coverage to better suit your needs.

Future Trends in Bundle Insurance

As we look ahead to 2025, the landscape of bundle insurance is poised to undergo significant changes driven by technological advancements and shifting consumer behaviors. Let's explore some key trends that are likely to shape the future of bundle insurance quotes.

Advancements in AI and Machine Learning

With the rise of artificial intelligence (AI) and machine learning technologies, insurance companies are expected to leverage these tools to enhance their pricing models and risk assessments for bundled policies. By analyzing vast amounts of data in real-time, insurers can offer more personalized and competitive bundle insurance quotes to customers.

Evolution of the Insurance Industry

By 2025, the insurance industry is anticipated to evolve towards more integrated and seamless bundled policies that cater to the diverse needs of customers. Insurers may introduce innovative products that combine various coverage options under a single umbrella, providing greater convenience and value to policyholders.

Impact of Consumer Behavior

Changes in consumer behavior, such as the growing preference for digital interactions and on-demand services, could influence the design and pricing of bundle insurance offerings. Insurers may need to adapt their strategies to meet the evolving expectations of tech-savvy customers who seek flexible and customized insurance solutions.

Ultimate Conclusion

In conclusion, understanding bundle insurance quotes and how to save more in 2025 can lead to substantial cost savings and better coverage options. By staying informed and comparing offers, individuals can make informed decisions for their insurance needs.

Clarifying Questions

Why is bundling insurance quotes important?

Bundling insurance quotes is crucial for cost savings as it often leads to discounted rates when multiple policies are combined.

How do personal factors affect bundle insurance costs?

Personal factors like age, location, and driving record can impact bundle insurance costs by influencing the risk profile of the policyholder.

How can technology help in comparing bundle insurance quotes?

Technology and online tools play a significant role in comparing bundle insurance quotes by providing easy access to multiple offers and pricing information.