Delve into the world of contractors and liability insurance with a focus on securing the best coverage. This article sheds light on the crucial aspects and considerations contractors should keep in mind.

Understanding Liability Insurance

Liability insurance is a crucial form of coverage for contractors, as it protects them from financial losses resulting from claims or lawsuits filed against them for property damage, bodily injury, or other liabilities.

Types of Liability Insurance for Contractors

- General Liability Insurance: Provides coverage for third-party claims of bodily injury, property damage, and personal injury.

- Professional Liability Insurance: Also known as Errors and Omissions insurance, it covers claims related to professional services provided by contractors.

- Product Liability Insurance: Protects contractors from claims arising from products they have manufactured or sold.

- Commercial Auto Liability Insurance: Covers liability for bodily injury or property damage resulting from accidents involving company vehicles.

How Liability Insurance Protects Contractors

Liability insurance safeguards contractors by covering legal fees, settlements, and judgments in the event of a covered claim or lawsuit. It provides financial security and peace of mind, allowing contractors to focus on their work without worrying about potential liabilities.

Factors to Consider When Choosing Liability Insurance

When choosing liability insurance as a contractor, there are several key factors to keep in mind to ensure adequate protection for your business.

Importance of Coverage Limits

- Understanding the coverage limits of your liability insurance is crucial as it determines the maximum amount the insurance company will pay for a covered claim.

- Higher coverage limits provide more protection but may also come with higher premiums.

- It is essential to assess your business's risks and choose coverage limits that adequately protect you in case of a claim.

Nature of the Contractor’s Work

- The nature of your work as a contractor can significantly influence the type of liability insurance you need.

- For example, if you work in a high-risk industry or perform hazardous tasks, you may require specialized liability coverage.

- General liability insurance may be sufficient for contractors with lower risk exposure, while those in high-risk fields may need additional coverage such as professional liability or pollution liability insurance.

Securing the Best Liability Insurance

When it comes to securing the best liability insurance for contractors, there are several key steps that can be taken to ensure adequate coverage for their specific needs.

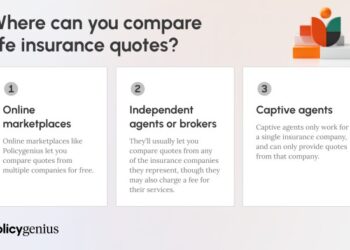

Comparing Different Insurance Providers

Before making a decision, it is crucial for contractors to compare different insurance providers and their offerings. This involves looking at the coverage options, policy limits, deductibles, and premiums offered by each provider.

Tailoring Policies to Specific Risks

Contractors face unique risks depending on the nature of their work. It is essential to work with an insurance provider to tailor liability insurance policies to address these specific risks. This may involve adding endorsements or additional coverage to ensure comprehensive protection.

Cost Considerations and Budgeting

Contractors need to carefully evaluate the costs associated with liability insurance to ensure they are getting adequate coverage without overspending. Understanding the factors that affect premiums and taking steps to manage insurance costs can help contractors budget effectively while protecting their business

Evaluating Insurance Costs

Before purchasing liability insurance, contractors should consider factors such as the type of coverage needed, the limits of coverage required, the size of the business, and the level of risk involved in their operations. Insurance providers will assess these factors to determine the cost of the policy.

Budgeting for Liability Insurance

When budgeting for liability insurance, contractors should allocate a specific amount of their overall budget to insurance costs. It is important to strike a balance between affordability and coverage adequacy. Setting aside a dedicated portion of the budget for insurance can help ensure that funds are available when premiums are due.

Managing Insurance Costs

To manage insurance costs without compromising on protection, contractors can consider options such as increasing deductibles, bundling policies, implementing risk management practices, and shopping around for competitive rates. By working with an experienced insurance agent and exploring different cost-saving strategies, contractors can secure the best liability insurance for their needs.

Common Mistakes to Avoid

When it comes to liability insurance, contractors can often make mistakes that can have serious consequences. It is crucial to be aware of these common pitfalls to ensure adequate coverage and protection.

Underestimating Coverage Needs

One common mistake contractors make is underestimating their coverage needs. Opting for lower coverage limits to save money may seem like a good idea initially, but it can leave contractors vulnerable to financial risks in the event of a claim.

It is essential to accurately assess the potential risks and liabilities involved in your line of work to determine the appropriate coverage limits.

Failure to Disclose Relevant Information

Another mistake is failing to disclose all relevant information when applying for liability insurance. Providing inaccurate or incomplete information can result in denied claims or even policy cancellation. It is important to be transparent and forthcoming with your insurer to avoid any issues down the line.

Choosing the Wrong Policy Type

Contractors may also make the mistake of choosing the wrong type of liability insurance policy for their specific needs. For example, general liability insurance may not cover certain risks that are common in the construction industry. It is essential to carefully review and select a policy that provides comprehensive coverage for your particular line of work.

Ignoring Contractual Requirements

Ignoring contractual requirements is another common mistake that contractors make. Many contracts with clients or subcontractors require specific types or amounts of liability insurance. Failing to meet these requirements can lead to legal disputes or loss of business opportunities. It is crucial to review and comply with all contractual obligations related to liability insurance.

Real-life Scenario Example:

Consider a scenario where a contractor working on a renovation project accidentally damages a client's property. Without proper liability insurance coverage, the contractor would be personally liable for the cost of repairs, which could amount to thousands of dollars. However, with the right insurance policy in place, the contractor would be protected from such financial liabilities, ensuring peace of mind and financial security.

Closing Summary

In conclusion, navigating the realm of liability insurance as a contractor requires attention to detail and strategic decision-making to ensure optimal protection.

User Queries

What factors should contractors consider when choosing liability insurance?

Contractors should consider coverage limits, nature of work, and key factors that align with their specific needs.

How can contractors tailor liability insurance policies to their specific risks?

By working closely with insurance providers to identify and address potential risks unique to their line of work.

What are the repercussions of inadequate liability insurance coverage?

Inadequate coverage can lead to financial liabilities and legal issues in case of accidents or lawsuits.