Delving into Over 50 Life Insurance: What Makes It Different?, this exploration promises a unique and captivating journey into the realm of insurance tailored for individuals over 50.

Providing insights into the distinct features and benefits that set this type of insurance apart from the rest.

What is Over 50 Life Insurance?

Over 50 Life Insurance is a type of life insurance specifically designed for individuals who are over the age of 50. It provides coverage for final expenses, such as funeral costs, outstanding debts, or leaving an inheritance to loved ones.

Target Audience

The target audience for Over 50 Life Insurance are individuals who are in their fifties or older and are looking to secure financial protection for their families or cover end-of-life expenses.

Comparison with Other Types of Life Insurance

- Over 50 Life Insurance typically offers smaller coverage amounts compared to traditional life insurance policies, as it is meant to cover specific expenses rather than provide long-term financial support.

- Unlike term life insurance, Over 50 Life Insurance does not have a set term and provides coverage until the policyholder passes away.

- Whole life insurance, on the other hand, may offer more comprehensive coverage and cash value accumulation over time, which is not a feature of Over 50 Life Insurance.

Features of Over 50 Life Insurance

When it comes to Over 50 Life Insurance policies, there are key features that set them apart from other types of life insurance. These features are specifically designed to cater to the needs of individuals over the age of 50, providing them with financial security and peace of mind.

No Medical Exam Required

- One of the main features of Over 50 Life Insurance is that no medical exam is required to qualify for coverage. This is especially beneficial for older individuals who may have pre-existing health conditions.

- Without the need for a medical exam, the application process is quick and easy, making it more accessible for those over 50 to secure life insurance coverage.

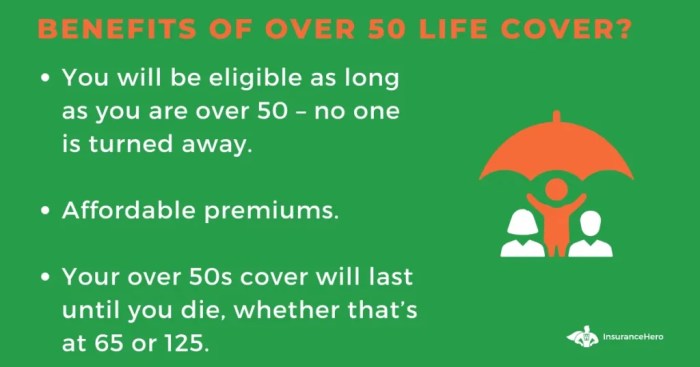

Guaranteed Acceptance

- Another important feature is guaranteed acceptance, meaning that as long as you fall within the age range, you will be approved for coverage. This is ideal for individuals who may have been denied coverage in the past due to health reasons.

- With guaranteed acceptance, you can have peace of mind knowing that your loved ones will receive a payout upon your passing, regardless of your health status.

Fixed Premiums

- Over 50 Life Insurance policies often come with fixed premiums, meaning that the cost of your coverage will not increase over time. This allows you to budget effectively and plan for the future without worrying about rising premiums.

- Fixed premiums provide stability and predictability, making it easier for individuals over 50 to manage their finances and ensure that their life insurance coverage remains affordable.

Limited Coverage Amounts

- While Over 50 Life Insurance offers many benefits, it's important to note that coverage amounts are typically limited compared to other types of life insurance. This may not be suitable for individuals looking for high coverage amounts.

- Individuals over 50 need to carefully consider their financial needs and obligations when selecting an Over 50 Life Insurance policy to ensure that the coverage amount meets their requirements.

Eligibility Criteria

When it comes to Over 50 Life Insurance, there are certain eligibility criteria that applicants need to meet in order to qualify for coverage

Age Requirement

As the name suggests, Over 50 Life Insurance is specifically designed for individuals who are 50 years old or above. This age requirement is a key factor in determining eligibility for this type of insurance.

Medical Examinations

Unlike traditional life insurance policies that may require extensive medical examinations, Over 50 Life Insurance typically does not mandate any medical tests or health assessments. This makes it easier for individuals in this age group to secure coverage without the need for invasive procedures.

Pre-existing Conditions

It's important to note that pre-existing medical conditions may not disqualify you from obtaining Over 50 Life Insurance. In fact, many providers offer guaranteed acceptance policies, which means you can still get coverage regardless of your health status.

Cost and Coverage

When it comes to Over 50 Life Insurance, understanding the cost structure and coverage options is essential for making an informed decision on which policy to choose.

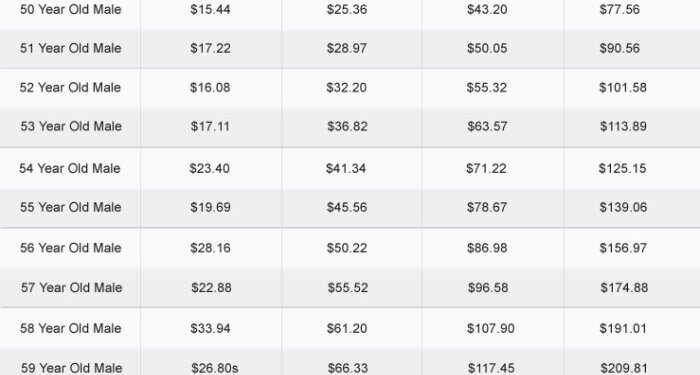

Cost Breakdown

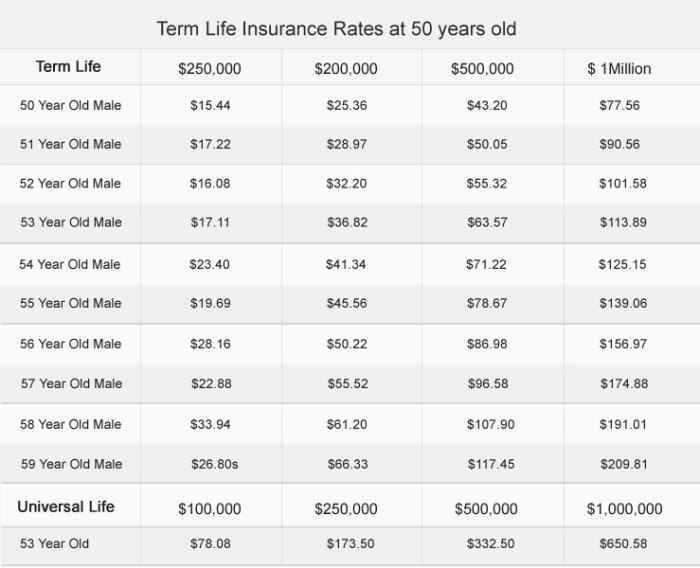

- Over 50 Life Insurance premiums typically depend on factors such as age, gender, health status, and coverage amount.

- Monthly premiums for Over 50 Life Insurance policies are usually fixed, making it easier to budget for.

- Some policies offer the option of paying premiums for a limited period or until a certain age, providing flexibility in terms of cost.

Coverage Options

- Over 50 Life Insurance policies often provide coverage for funeral expenses, outstanding debts, and leaving an inheritance for loved ones.

- Some policies may include additional benefits such as critical illness cover or terminal illness cover for added financial protection.

- Policyholders can choose the coverage amount based on their individual needs and financial goals.

Cost and Coverage Interaction

For example, a 55-year-old individual may opt for a higher coverage amount to ensure their loved ones are financially secure in case of their passing. This decision would result in higher monthly premiums compared to a lower coverage amount.

Closure

Concluding our discussion on Over 50 Life Insurance: What Makes It Different?, we unravel the key points and leave you with a comprehensive understanding of this specialized insurance domain.

FAQ

What age group is Over 50 Life Insurance designed for?

Over 50 Life Insurance is specifically tailored for individuals who are 50 years old and above.

Are medical examinations necessary for applying for Over 50 Life Insurance?

Generally, Over 50 Life Insurance does not require extensive medical examinations, making it more accessible for older individuals.

How do the costs of Over 50 Life Insurance premiums usually breakdown?

The cost structure of Over 50 Life Insurance premiums typically considers factors like age, coverage amount, and any pre-existing conditions.