Embark on a journey through the future of auto insurance with our comprehensive guide. From the evolution of trends to the impact of technology, this introduction sets the stage for an enlightening exploration of what's to come in 2025.

Explore the various types of policies, factors influencing costs, and how to navigate the world of auto insurance with ease and confidence.

Introduction to Auto Insurance in 2025

As we step into the year 2025, the landscape of auto insurance is undergoing significant transformations driven by various factors, including technological advancements and changing consumer behaviors. Understanding the evolving trends in auto insurance is crucial for both insurance providers and consumers to navigate the future effectively.

Evolution of Auto Insurance Trends

The auto insurance industry has seen a shift towards personalized and usage-based insurance policies. Insurers are leveraging data analytics and telematics to tailor coverage plans according to individual driving habits and risk profiles. This shift towards customization is providing consumers with more flexibility and cost-effective options.

Key Factors Influencing the Industry

- Advancements in Artificial Intelligence (AI) and Machine Learning are enabling insurers to streamline claim processes, detect fraud more effectively, and improve risk assessment models.

- Changing regulatory landscapes and environmental concerns are prompting insurers to offer eco-friendly insurance products and solutions to address climate change-related risks.

- The rise of autonomous vehicles and shared mobility services is reshaping the traditional concepts of auto insurance, leading to new collaborations and partnerships within the industry.

Impact of Technology on Auto Insurance Purchases

Technology continues to revolutionize how consumers shop for auto insurance in 2025. With the rise of Insurtech companies and online platforms, purchasing insurance has become more accessible and convenient. Consumers can compare quotes, review policy details, and make informed decisions from the comfort of their homes, driving a shift towards digital-first interactions in the insurance sector.

Understanding Different Types of Auto Insurance Policies

When it comes to auto insurance, there are several types of coverage options available to drivers. Understanding the differences between these policies can help you make an informed decision when selecting the right coverage for your needs.

Comprehensive vs. Liability Insurance

Comprehensive insurance and liability insurance are two common types of auto insurance policies that offer different levels of coverage.

- Comprehensive Insurance:This type of insurance provides coverage for damages to your vehicle that are not caused by a collision, such as theft, vandalism, or natural disasters. It offers a broader range of protection compared to liability insurance.

- Liability Insurance:Liability insurance covers damages and injuries you cause to others in an accident. It is typically required by law and does not cover damages to your own vehicle.

Add-On Coverage Options

Aside from the basic coverage offered by comprehensive and liability insurance, there are add-on coverage options that can provide additional protection and benefits.

- Roadside Assistance:This coverage offers help in case of roadside emergencies, such as towing, flat tire assistance, and fuel delivery.

- Rental Reimbursement:If your car is in the shop for repairs after an accident, rental reimbursement coverage can help cover the cost of a rental car.

Factors Influencing Auto Insurance Costs in 2025

In 2025, several factors continue to play a significant role in determining auto insurance costs. Understanding these factors is crucial for consumers to make informed decisions when purchasing insurance policies.Driving Habits and Vehicle Technologies:Advancements in vehicle technologies have revolutionized the automotive industry.

While features like autonomous emergency braking and lane-keeping assist enhance safety, they also impact insurance rates. Vehicles equipped with these technologies are often considered safer and may qualify for discounts. On the other hand, aggressive driving habits, such as speeding or frequent hard braking, can lead to higher premiums due to increased risk of accidents.Role of Personal Data and Telematics:In 2025, the use of personal data and telematics devices continues to influence auto insurance costs.

Insurance companies utilize telematics technology to track driving behavior, such as mileage, speed, and braking patterns. By analyzing this data, insurers can offer personalized premiums based on individual driving habits. Drivers who demonstrate safe driving practices may benefit from lower rates, while risky behaviors could result in higher premiums.

Impact of Vehicle Type on Insurance Costs

The type of vehicle you drive can significantly impact your auto insurance costs in 2025. Sports cars or luxury vehicles are considered higher risk due to their higher repair costs and increased likelihood of theft. Insuring a vehicle with advanced safety features, such as collision avoidance systems, can help reduce insurance premiums.

It's essential to consider the insurance implications when purchasing a new vehicle to avoid unexpected cost increases.

Regional Factors and Insurance Costs

Insurance costs can vary based on your geographic location in 2025. Urban areas with higher population densities and increased traffic congestion may experience higher insurance premiums due to elevated accident rates. Additionally, regions prone to extreme weather conditions, such as hurricanes or snowstorms, can impact insurance costs.

Understanding the regional factors that influence insurance rates can help drivers anticipate potential changes in premiums and make informed decisions

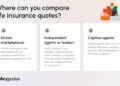

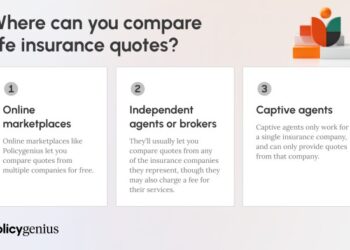

How to Shop for Auto Insurance in 2025

In order to find the best auto insurance deal in 2025, it is important to follow a systematic approach when comparing quotes online. Leveraging technology can help you navigate through the vast array of options available and ensure you make an informed decision.

Steps for Comparing Auto Insurance Quotes Online

- Research and gather information on different insurance providers.

- Use comparison websites to obtain multiple quotes at once.

- Enter accurate details about your vehicle and driving history for precise quotes.

- Review the coverage options and premiums offered by each provider.

- Consider additional factors such as customer reviews and ratings.

Tips for Leveraging Technology to Find the Best Deals

- Utilize mobile apps to easily compare quotes on-the-go.

- Set up alerts for price drops or new deals from insurance providers.

- Use online chat support to clarify any doubts or queries instantly.

- Opt for paperless transactions to streamline the process and save time.

Importance of Reviewing Policy Details and Exclusions

When shopping for auto insurance, it is crucial to carefully review policy details and exclusions to avoid any surprises in the future. Pay close attention to coverage limits, deductibles, and any specific exclusions that may apply to your policy.

Future Trends in Auto Insurance Shopping

In the ever-evolving landscape of auto insurance, several futuristic trends are set to transform the way consumers shop for policies in 2025. From the integration of AI and machine learning to the rise of usage-based insurance and blockchain technology, the industry is poised for significant changes.

AI and Machine Learning Revolutionizing Auto Insurance Shopping

AI and machine learning algorithms are expected to play a pivotal role in revolutionizing the auto insurance shopping experience. These technologies will enable insurance companies to analyze vast amounts of data quickly, providing personalized policy recommendations based on individual driving habits, demographics, and risk profiles.

By leveraging AI, insurers can streamline the quoting process, offer more accurate pricing, and enhance customer satisfaction through tailored coverage options.

Usage-Based Insurance and its Impact on Policy Pricing

Usage-based insurance, also known as telematics insurance, is gaining traction as a popular option for policyholders seeking more flexible and personalized coverage. This innovative approach utilizes data collected from telematics devices installed in vehicles to assess driving behavior in real-time.

By rewarding safe driving habits with lower premiums and incentivizing policyholders to drive responsibly, usage-based insurance has the potential to revolutionize traditional pricing models and promote safer roads.

Blockchain Technology for Transparency and Security in Auto Insurance Transactions

Blockchain technology is poised to enhance transparency and security in auto insurance transactions by providing a decentralized and tamper-proof platform for storing and sharing policyholder information. Through blockchain-powered smart contracts, insurers can automate claims processing, reduce fraud, and improve data integrity.

This technology enables greater trust between insurers and policyholders, ensuring a more efficient and secure insurance experience for all parties involved.

Final Thoughts

As we conclude this insightful discussion on shopping for auto insurance in 2025, remember to stay informed, compare wisely, and embrace the advancements that shape the future of insurance.

Essential FAQs

What are some emerging trends in auto insurance by 2025?

Emerging trends include AI integration, usage-based insurance, and blockchain technology for enhanced security.

How can I find the best insurance deals in 2025?

To find the best deals, utilize online comparison tools, leverage technology for quotes, and review policy details carefully.

What factors will impact auto insurance costs in 2025?

Factors like driving habits, vehicle technology, and personal data usage will play a significant role in determining insurance costs.