As Automotive Insurance Quote: What Indians Often Overlook takes center stage, this opening passage beckons readers with a captivating overview of key factors, commonly overlooked coverage options, understanding of NCB and deductibles, and the importance of reviewing policy terms and conditions.

The content promises to be informative and engaging, providing valuable insights for Indian consumers navigating the world of automotive insurance.

Factors to Consider When Choosing Automotive Insurance

When selecting automotive insurance in India, there are several key factors that individuals should carefully consider to ensure they have the right coverage for their vehicles and driving needs.

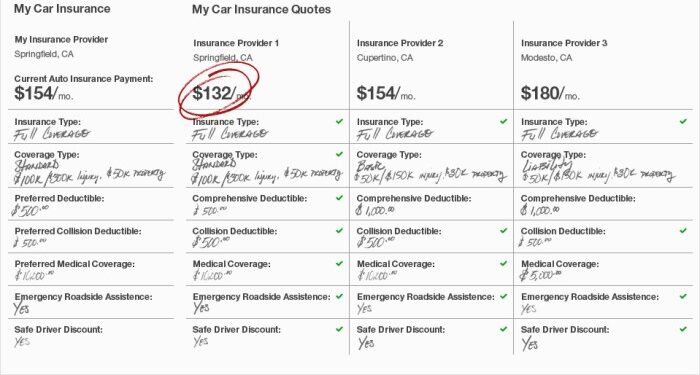

Assessing Coverage Limits and Deductibles

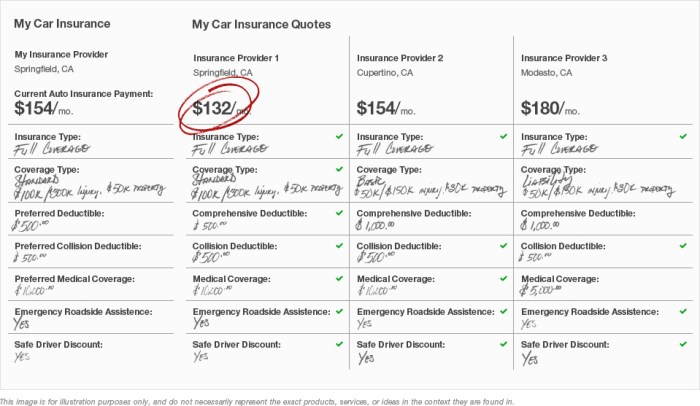

- It is crucial to assess the coverage limits of an insurance policy to ensure that it provides adequate protection in case of an accident or damage.

- Understanding the deductibles is important as it determines the out-of-pocket expenses that the policyholder will need to pay before the insurance coverage kicks in.

- Choosing higher deductibles can result in lower premiums but may require more out-of-pocket costs in the event of a claim.

Evaluating Add-On Covers and Exclusions

- Reviewing add-on covers like zero depreciation, roadside assistance, and engine protection can enhance the overall protection provided by the insurance policy.

- Checking for exclusions such as off-road coverage, consequential damage, or driving under the influence can help avoid unexpected gaps in coverage.

- Understanding the terms and conditions related to add-on covers and exclusions is essential to make an informed decision about the policy.

Impact of Vehicle Types on Insurance Premiums

- The type of vehicle, including its make, model, age, and usage, can significantly impact the insurance premiums.

- High-end luxury cars or imported vehicles may attract higher premiums due to their expensive repair and replacement costs.

- Commercial vehicles used for business purposes may have different insurance requirements and premium rates compared to personal vehicles.

Commonly Overlooked Coverage Options

When it comes to automotive insurance, there are several coverage options that Indians often overlook. These options can provide additional benefits and protection in case of unforeseen circumstances.

Roadside Assistance Coverage

- Roadside assistance is a valuable add-on that provides support in case your vehicle breaks down or you encounter any other roadside emergency.

- Services typically include towing, battery jump-start, fuel delivery, and flat tire assistance, among others.

- Having roadside assistance can save you time, money, and stress when facing unexpected car troubles on the road.

Zero Depreciation Cover and Engine Protect Add-Ons

- Zero depreciation cover ensures that you receive the full claim amount without deduction for depreciation of car parts during repairs.

- Engine protect add-ons provide coverage for repair or replacement of the engine in case of damages due to accidents or other reasons.

- These add-ons can help you avoid out-of-pocket expenses and maintain the value of your vehicle in the long run.

Personal Accident Cover

- Personal accident cover offers financial protection in case of accidental death or disability of the policyholder or passengers in the insured vehicle.

- It provides compensation for medical expenses, loss of income, and other related costs resulting from accidents.

- Including personal accident cover in your automotive insurance policy can provide peace of mind and security for you and your loved ones.

Understanding No Claim Bonus (NCB) and Deductibles

When it comes to automotive insurance, understanding concepts like No Claim Bonus (NCB) and deductibles can help you make informed decisions that can ultimately save you money. Let's delve into these important aspects of insurance coverage.

No Claim Bonus (NCB)

No Claim Bonus (NCB) is a reward given by insurance companies to policyholders who do not make any claims during the policy period. This bonus is in the form of a discount on the premium, encouraging safe driving practices and responsible behavior on the road.

- One strategy to maximize NCB benefits is to drive carefully and avoid making small claims that could impact your bonus.

- By maintaining a claim-free record, you can gradually increase your NCB percentage, leading to significant savings on your insurance premiums over time.

Deductibles

Deductibles are the out-of-pocket expenses that policyholders are required to pay before their insurance coverage kicks in. Choosing higher deductibles can lower your insurance premiums, but it's essential to understand how this decision can affect your financial responsibility in case of a claim.

- For example, opting for a higher deductible of $1,000 instead of $500 can result in lower monthly premiums. However, you need to be prepared to cover the $1,000 deductible in case of an accident or damage to your vehicle.

- By evaluating your financial situation and risk tolerance, you can decide on an appropriate deductible that balances your premium costs and potential out-of-pocket expenses.

Importance of Reviewing Policy Terms and Conditions

When it comes to automotive insurance, reviewing the policy terms and conditions is crucial to ensure you have a clear understanding of your coverage and obligations.

Not paying attention to the fine print or overlooking important details in your policy can lead to misunderstandings, disputes, or even financial losses in the event of a claim.

Key Points to Consider When Reviewing Policy Terms and Conditions

- Check the coverage limits and exclusions to understand what is and isn't covered under your policy.

- Review the deductible amount you are required to pay in the event of a claim and ensure it aligns with your budget.

- Verify the terms related to claim procedures, including deadlines for reporting incidents and filing claims.

- Understand the implications of any endorsements or add-ons to your policy, such as roadside assistance or rental car coverage.

Tips for Ensuring Accurate and Up-to-Date Policy Documentation

- Keep a copy of your policy documents in a secure and easily accessible location for reference.

- Regularly review your policy to make sure it reflects any changes in your circumstances or coverage needs.

- Contact your insurance provider if you have any questions or need clarification on specific policy terms or conditions.

- Be proactive in updating your policy information to avoid any gaps or inaccuracies in your coverage.

Final Conclusion

In conclusion, Automotive Insurance Quote: What Indians Often Overlook sheds light on critical aspects of automotive insurance that are often missed. By understanding these factors, consumers can make more informed decisions when selecting insurance coverage. This comprehensive discussion serves as a guide to help Indians navigate the complexities of automotive insurance with confidence and clarity.

FAQ Compilation

What is No Claim Bonus (NCB) and how does it impact insurance premiums?

NCB is a reward given by insurance companies to policyholders for not making any claims during the policy term. It can lead to a discount on the renewal premium.

Why is it important to include roadside assistance in insurance policies?

Roadside assistance provides help in case of breakdowns or emergencies while on the road, offering peace of mind and convenience to policyholders.

How can choosing higher deductibles lower insurance premiums?

Opting for higher deductibles means you agree to pay more out of pocket in case of a claim, which can reduce the risk for the insurance company and result in lower premiums for you.