Cheap Auto Insurance and How to Find It Safely sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with casual formal language style and brimming with originality from the outset.

Exploring the intricacies of affordable auto insurance and navigating the landscape of finding it securely opens up a world of possibilities for drivers looking to save on costs without compromising on coverage.

Understanding Cheap Auto Insurance

When it comes to auto insurance, finding a policy that is both affordable and provides adequate coverage is crucial. Cheap auto insurance refers to policies that offer low premiums while still meeting the minimum legal requirements for coverage.

Key Factors Influencing Auto Insurance Rates

- Driving Record: A history of accidents or traffic violations can increase insurance rates.

- Age and Gender: Younger drivers and males typically pay higher premiums.

- Vehicle Type: The make, model, and age of the car can impact insurance costs.

- Location: Urban areas with higher crime rates may result in higher premiums.

Types of Coverage Options in Cheap Auto Insurance

- Liability Coverage: Covers injuries and damages to others in an accident you are at fault for.

- Collision Coverage: Pays for damages to your vehicle in a collision, regardless of fault.

- Comprehensive Coverage: Protects your vehicle from non-collision events like theft or natural disasters.

Benefits and Limitations of Opting for Cheap Auto Insurance

Opting for cheap auto insurance can help you save money on premiums, making it more affordable to maintain coverage. However, it may come with limitations such as higher deductibles, lower coverage limits, or fewer add-on options compared to more expensive policies.

Factors Affecting Auto Insurance Costs

When it comes to determining auto insurance rates, several factors come into play. Understanding these factors can help you make informed decisions to potentially lower your insurance premiums.

Driver’s Age, Driving Record, and Location

- Younger drivers typically face higher insurance rates due to their lack of experience and higher likelihood of accidents.

- Drivers with a history of accidents or traffic violations may also see increased insurance costs.

- The location where you live and park your car can impact rates, with higher rates in areas with higher crime rates or traffic congestion.

Type of Vehicle, Mileage, and Usage

- The make and model of your vehicle can affect insurance costs, with luxury or high-performance cars generally costing more to insure.

- Higher mileage on your vehicle can lead to increased wear and tear, potentially raising insurance rates.

- How you use your car, such as for commuting or business purposes, can also impact insurance premiums.

Bundling Policies and Choosing Higher Deductibles

- Insurance companies often offer discounts for bundling multiple policies, such as auto and home insurance, with the same provider.

- Opting for a higher deductible can lower your monthly premiums, but keep in mind that you'll have to pay more out of pocket in the event of a claim.

Discounts and Incentives

- Insurance companies may offer discounts for safe driving habits, such as completing defensive driving courses.

- Young drivers may qualify for good student discounts if they maintain a certain GPA.

- Installing anti-theft devices or safety features in your vehicle could also lead to lower insurance rates.

How to Find Cheap Auto Insurance Safely

Finding cheap auto insurance safely involves thorough research and comparison to ensure you get the best coverage at an affordable price. It is important to design a strategy for accurately assessing your coverage needs before purchasing auto insurance to avoid overpaying or being underinsured.

Additionally, you need to be cautious of scams or fraudulent schemes when looking for cheap auto insurance. Organizing a checklist of documents and information required to apply for auto insurance quotes can help streamline the process and ensure you have all the necessary details at hand.

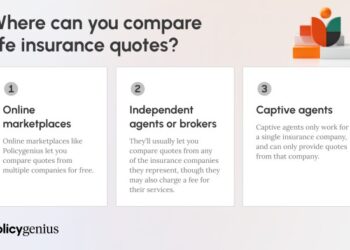

Researching and Comparing Insurance Providers

- Start by gathering a list of reputable insurance providers in your area.

- Check their customer reviews and ratings to gauge their reliability.

- Compare the coverage options and prices offered by each provider.

- Look for discounts or special offers that can help lower your insurance premium.

Assessing Coverage Needs

- Determine the minimum coverage required by your state.

- Evaluate your driving habits, the value of your vehicle, and your financial situation to determine the ideal coverage level for you.

- Consider factors like your age, driving record, and the likelihood of accidents in your area when assessing your coverage needs.

- Consult with an insurance agent for personalized guidance on selecting the right coverage.

Avoiding Scams and Fraudulent Schemes

- Be cautious of insurance offers that seem too good to be true.

- Avoid providing personal information to unverified sources or suspicious websites.

- Verify the legitimacy of the insurance provider before making any payments.

- Report any suspicious activity or fraudulent schemes to the appropriate authorities.

Checklist for Applying for Auto Insurance Quotes

- Driver's license information

- Vehicle registration details

- Driving history and record of any past accidents

- Information about additional drivers on the policy

- Details of any existing insurance coverage

- Vehicle mileage and usage

- Payment information for premium processing

Utilizing Technology for Finding Affordable Coverage

With the advancement of technology, finding affordable auto insurance coverage has become more convenient and efficient. Utilizing various online tools and platforms can help you navigate through the multitude of options available to secure the best deal for your insurance needs.

Online Comparison Tools for Finding Cheap Auto Insurance

- Online comparison tools allow you to input your information once and receive multiple insurance quotes from various providers. This saves you time and effort in individually contacting each insurance company for rates.

- By comparing quotes side by side, you can easily identify the most cost-effective options that offer the coverage you require. This transparency empowers you to make an informed decision based on your budget and needs.

Benefits of Utilizing Apps or Websites for Comparing Insurance Rates

- Apps and websites dedicated to comparing insurance rates streamline the process even further, offering user-friendly interfaces and real-time updates on available deals.

- These platforms often provide exclusive discounts or promotions that may not be readily available through traditional channels. This can result in additional savings on your insurance premiums.

Importance of Understanding Online Reviews and Ratings

- Before committing to an insurance provider, it is crucial to review online ratings and feedback from other policyholders. This insight can give you a glimpse into the customer service quality and claims process of the company.

- Positive reviews indicate reliability and customer satisfaction, while negative reviews may raise red flags regarding the insurer's practices. Taking the time to research and analyze feedback can help you choose a reputable and trustworthy insurance company.

Impact of Telematics Devices and Usage-Based Insurance on Costs

- Telematics devices, such as plug-in trackers or mobile apps, monitor your driving habits and provide data to insurance companies. Safe driving behaviors can lead to discounts or lower premiums through usage-based insurance programs.

- By opting for telematics-based insurance, you have the opportunity to proactively reduce your insurance costs by demonstrating responsible driving practices. This personalized approach rewards safe drivers with tailored pricing based on their individual driving patterns.

Last Point

In conclusion, Cheap Auto Insurance and How to Find It Safely equips you with the knowledge and tools to make informed decisions when it comes to securing economical yet robust insurance protection for your vehicle. As you embark on this journey towards financial prudence and safety on the roads, remember that the right coverage is just a few steps away.

FAQ Guide

What factors determine the cost of cheap auto insurance?

The cost of cheap auto insurance is influenced by factors such as the driver's age, driving record, location, type of vehicle, and coverage options chosen.

How can I avoid scams when looking for affordable auto insurance?

To avoid scams, research and compare different insurance providers, verify their legitimacy, and be cautious of deals that seem too good to be true.

Are there discounts available for reducing auto insurance costs?

Yes, insurance companies offer discounts for various reasons such as safe driving habits, bundling policies, and choosing higher deductibles.